Consider the table.

Shirts

Pants

Year Price Quantity

Price Quantity

2013 $7...

Business, 15.02.2021 01:10 Rayanecrazt3671

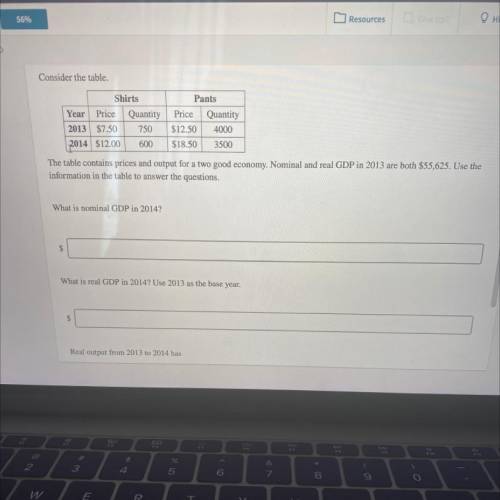

Consider the table.

Shirts

Pants

Year Price Quantity

Price Quantity

2013 $7.50 750 $12.50 4000

2014 $12.00 600 $18.50 3500

The table contains prices and output for a two good economy. Nominal and real GDP in 2013 are both $55,625. Use the

information in the table to answer the questions.

What is nominal GDP in 2014?

$

What is real GDP in 2014? Use 20132013 as the base year.

Real output from 2013 to 2014 has

Decreased

Experienced inflation

Increased

Stayed the same

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

Business, 22.06.2019 20:00

With the slowdown of business, how can starbucks ensure that the importance of leadership development does not get overlooked?

Answers: 3

Business, 22.06.2019 21:10

The blumer company entered into the following transactions during 2012: 1. the company was started with $22,000 of common stock issued to investors for cash. 2. on july 1, the company purchased land that cost $15,500 cash. 3. there were $700 of supplies purchased on account. 4. sales on account amounted to $9,500. 5. cash collections of receivables were $5,500. 6. on october 1, 2012, the company paid $3,600 in advance for a 12-month insurance policy that became effective on october 1. 7. supplies on hand as of december 31, 2010 amounted to $225. the amount of cash flow from investing activities would be:

Answers: 2

Business, 22.06.2019 21:40

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

You know the right answer?

Questions

Law, 04.04.2020 12:35

Health, 04.04.2020 12:35

Mathematics, 04.04.2020 12:36

History, 04.04.2020 12:36

Mathematics, 04.04.2020 12:36

Mathematics, 04.04.2020 12:37