Mathematics, 11.05.2021 01:00 hannaboo53

Examine the Federal Tax Table for married couples filing joint returns.

Married Couples Filing Jointly

If Taxable Income Is between: Then the Tax Due Is:

$0 – $19,400 10% of taxable income

$19,401 – $78,950 $1940+12% of the amount over $19,400

$78,951 – $168,400 $9086+22% of the amount over $78,950

$168,401 – $321,450 $28,765+24% of the amount over $168,400

$321,451 – $408,200 $65,497+32% of the amount over $321,450

$408,201 – $612,350 $93,257+35% of the amount over $408,200

$612,351+ $164,709.50+37% of the amount over $612,350

Sally and her husband, Ahmed, together earned a total of $203,300 in taxable income last year. Using the tax table, what do they owe in federal income taxes? Enter your answer rounded to the nearest dollar, such as: $42,536

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 19:30

Mr. brettler is hanging up a 5-foot tall rectangular welcome sign in the gym. he has drawn a sketch on a coordinate grid. he has the lower vertices of the sign at (9, –3) and (–6, –3). where would the upper vertices be on the grid?

Answers: 1

Mathematics, 21.06.2019 20:00

An investment decreases in value by 30% in the first year and decreases by 40% in the second year. what is the percent decrease in percentage in the investment after two years

Answers: 1

Mathematics, 21.06.2019 20:30

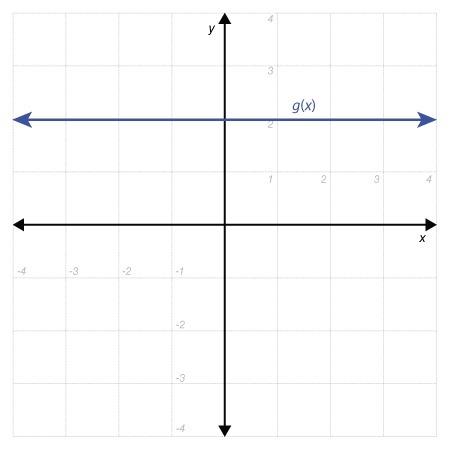

Which steps could be part of the process in algebraically solving the system of equations, y+5x=x^2+10 and y=4x-10

Answers: 2

You know the right answer?

Examine the Federal Tax Table for married couples filing joint returns.

Married Couples Filing Joi...

Questions

History, 22.10.2019 08:50

Mathematics, 22.10.2019 08:50

History, 22.10.2019 08:50

Mathematics, 22.10.2019 08:50

Mathematics, 22.10.2019 08:50