Mathematics, 03.06.2020 18:58 KallMeh

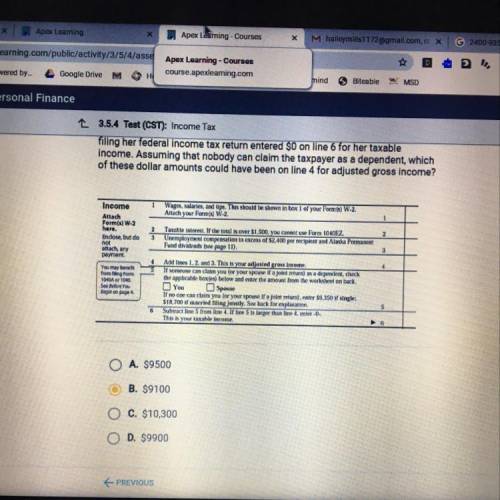

In the Income section shown below from the 1040EZ form, a single taxpayer

filing her federal income tax return entered $0 on line 6 for her taxable

income. Assuming that nobody can claim the taxpayer as a dependent, which

of these dollar amounts could have been on line 4 for adjusted gross income?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:30

What could explain what happened when the time was equal to 120 minutes

Answers: 2

Mathematics, 21.06.2019 18:30

The distance between two cities is 368 miles. if the scale on the map is 1/4 inch=23 miles, what is the distance between the cities on the map?

Answers: 3

Mathematics, 21.06.2019 23:00

What are two numbers that add up to -9 and multiply to -10 best answer gets branliest and 100 extra points

Answers: 1

You know the right answer?

In the Income section shown below from the 1040EZ form, a single taxpayer

filing her federal income...

Questions

Mathematics, 24.06.2020 23:01

Mathematics, 24.06.2020 23:01

Mathematics, 24.06.2020 23:01

Mathematics, 24.06.2020 23:01

Physics, 24.06.2020 23:01

Mathematics, 24.06.2020 23:01

Mathematics, 24.06.2020 23:01