Mathematics, 04.07.2019 06:30 fsdfsf

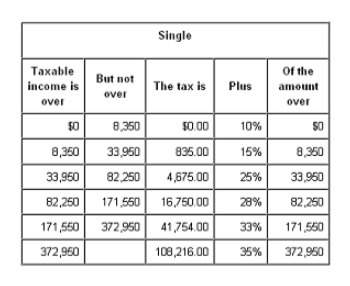

Aperson filing his federal income tax return with the single filing status had a taxable income of $168,050. according to the table below, how much of that income will he have left over after paying his federal income tax. a. $144,026.00 b. $24,024.00 c. $127,276.00 d. $40,774.00

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:40

How can the correlation in the scatter plot graph below best be described? positive correlation negative correlation both positive and negative no correlation

Answers: 1

Mathematics, 21.06.2019 22:30

Which term below correctly completes the following sentence? if a function has a vertical asymptote at a certain x value, then the function is what at that value

Answers: 1

Mathematics, 21.06.2019 22:30

For the chance to be team captain, the numbers 1-30 are put in a hat and you get two chances to pick a number, without replacement. which formula correctly shows how to find the probability that you choose the number 1 and then 2?

Answers: 1

You know the right answer?

Aperson filing his federal income tax return with the single filing status had a taxable income of $...

Questions

Mathematics, 06.06.2020 04:01

Mathematics, 06.06.2020 04:01

English, 06.06.2020 04:01

Mathematics, 06.06.2020 04:01