2

Retu

Part 2 of 3

1

points

Required information

Exercise 3-34 Over...

Business, 30.05.2021 20:10 daymakenna3

2

Retu

Part 2 of 3

1

points

Required information

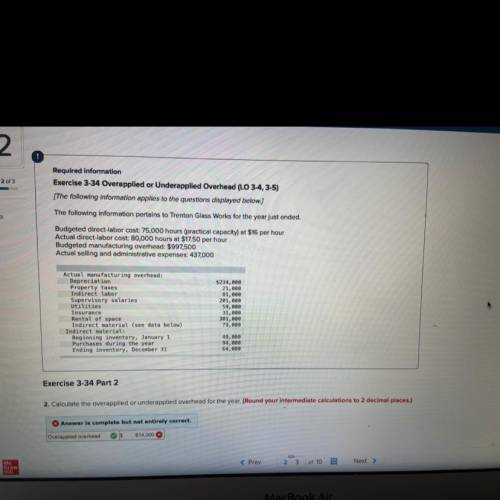

Exercise 3-34 Overapplied or Underapplied Overhead (LO 3-4,3-5)

(The following information applies to the questions displayed below.)

The following information pertains to Trenton Glass Works for the year just ended.

Budgeted direct-labor cost: 75,000 hours (practical capacity) at $16 per hour

Actual direct-labor cost: 80,000 hours at $17.50 per hour

Budgeted manufacturing overhead: $997,500

Actual selling and administrative expenses: 437,000

Actual manufacturing overhead:

Depreciation

Property taxes

Indirect labor

Supervisory salaries

Utilities

Insurance

Rental of space

Indirect material (see data below)

Indirect material:

Beginning inventory, January 1

Purchases during the year

Ending inventory, December 31

$234,000

21,000

81,000

201,000

59,000

31,000

301,200

79,000

49,000

94,000

64,000

Exercise 3-34 Part 2

2. Calculate the overapplied or underapplied overhead for the year. (Round your intermediate calculations to 2 decimal places.)

.

Answer is complete but not entirely correct.

Overapplied overhead

$

614.000 $

Answers: 2

Another question on Business

Business, 21.06.2019 22:10

Fess receives wages totaling $74,500 and has net earnings from self-employment amounting to $71,300. in determining her taxable self-employment income for the oasdi tax, how much of her net self-employment earnings must fess count? a. $74,500 b. $71,300 c. $53,900 d. $127,200 e. none of the above.

Answers: 3

Business, 22.06.2019 21:50

By which distribution system is more than 90 percent of u.s. coal shipped? a. pipelinesb. trucksc. waterwaysd. railroadse. none of the above

Answers: 1

Business, 22.06.2019 22:10

Afirm plans to begin production of a new small appliance. the manager must decide whether to purchase the motors for the appliance from a vendor at $10 each or to produce them in-house. either of two processes could be used for in-house production; process a would have an annual fixed cost of $200,000 and a variable cost of $7 per unit, and process b would have an annual fixed cost of $175,000 and a variable cost of $8 per unit. determine the range of annual volume for which each of the alternatives would be best. (round your first answer to the nearest whole number. include the indifference value itself in this answer.)

Answers: 2

Business, 23.06.2019 09:40

When providing the square footage of a property for sale, the salesperson should disclose what?

Answers: 3

You know the right answer?

Questions

Social Studies, 29.07.2019 22:00

Biology, 29.07.2019 22:00

Computers and Technology, 29.07.2019 22:00

Social Studies, 29.07.2019 22:00

Computers and Technology, 29.07.2019 22:00

History, 29.07.2019 22:00

History, 29.07.2019 22:00

Chemistry, 29.07.2019 22:00

Computers and Technology, 29.07.2019 22:00