Business, 28.04.2021 17:30 jflakes406

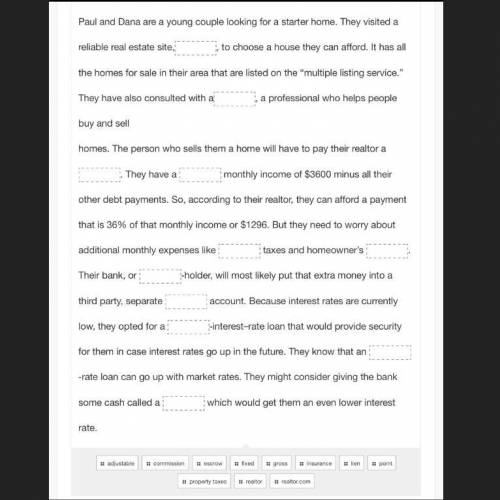

Paul and Dana are a young couple looking for a starter home. They visited a reliable real estate site_

to choose a house they can

afford. It has all the homes for sale in their area that are listed on the multiple listing service. They have also consulted with a_a

professional who helps people buy and sell

homes. The person who sells them a home will have to pay their realtor a_

They have a_

monthly income of $3600

minus all their other debt payments. So, according to their realtor, they can afford a payment that is 36% of that monthly income or S1296. But they

need to worry about additional monthly expenses like_

taxes and homeowner's

Their bank, or_

holder, will most likely put that extra money into a third party, separate_

account. Because interest rates are currently low, they opted

for a_

interest-rate loan that would provide security for them in case interest rates go up in the future. They know that an

_-rate loan can go up with market rates. They might consider giving the bank some cash called a_

which would get

them an even lower interest rate.

Answers: 3

Another question on Business

Business, 22.06.2019 16:10

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

Business, 22.06.2019 19:00

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

Business, 23.06.2019 00:20

Barney corporation recognized a $100 million preferred stock balance on 12/31/2019. on january 1, 2020, barney issued $10 million in preferred dividends. on the same date, barney raised an additional $20 million via a new issuance of preferred stock. on december 31, 2020, the market value of the original amount of preferred shares rose $5 million. under us gaap, the 12/31/2020 year ending preferred stock balance is:

Answers: 3

Business, 23.06.2019 07:40

Given the production function q=96(k^0.3)(l^0.7), find the mpk and mpl functions. is mpk a function of k alone, or of both k and l? what about mpl?

Answers: 2

You know the right answer?

Paul and Dana are a young couple looking for a starter home. They visited a reliable real estate sit...

Questions

Computers and Technology, 08.10.2019 02:30

Mathematics, 08.10.2019 02:30

Chemistry, 08.10.2019 02:30