You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%. The T-bill rate is 8%.

A. Your client chooses to invest 70% of a portfolio in you fund and 30% in an essentially risk-free money market fund. What is the expected value and standard deviation of the rate of return on his portfolio?

B. Suppose that your risky portfolio includes the following investments in the given proportions:

Stock A 25%

Stock B 32%

Stock C 43%

What are the investment proportions of your client's overall portfolio, including the position in T-bills?

C. What is the reward-to-volatility (Sharpe) ratio (S) of you risky portfolio? Your clients?

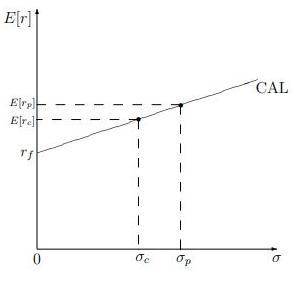

D. Draw the CAL of your portfolio on an expected return-standard deviation diagrm. What is the slop of the CAL? Show the position of your client on your fund's CAL.

Answers: 2

Another question on Business

Business, 22.06.2019 07:30

Jewelry manufacturers produce a range of products such as rings, necklaces, bracelets, and brooches. what fundamental economic question are they addressing by offering this range of items?

Answers: 3

Business, 22.06.2019 15:40

Colter steel has $5,550,000 in assets. temporary current assets $ 3,100,000 permanent current assets 1,605,000 fixed assets 845,000 total assets $ 5,550,000 assume the term structure of interest rates becomes inverted, with short-term rates going to 10 percent and long-term rates 2 percentage points lower than short-term rates. earnings before interest and taxes are $1,170,000. the tax rate is 40 percent earnings after taxes = ?

Answers: 1

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

Business, 22.06.2019 19:50

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

You know the right answer?

You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%....

Questions

Mathematics, 19.10.2019 05:10