Business, 23.05.2020 23:03 sissygirl0807

Nautical has two classes of stock authorized: $10 par preferred, and $1 par value common. As of the beginning of 2018, 150 shares of preferred stock and 2,200 shares of common stock have been issued. The following transactions affect stockholders’ equity during 2018:

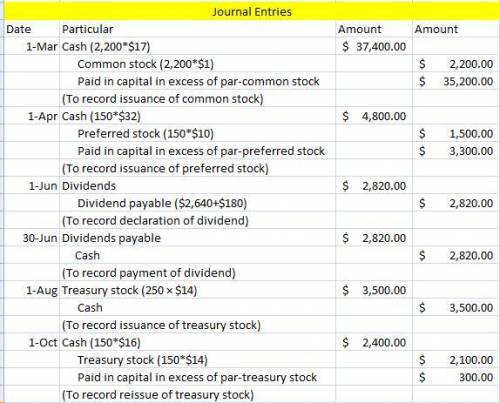

March 1 Issue 2,200 additional shares of common stock for $17 per share.

April 1 Issue 150 additional shares of preferred stock for $32 per share.

June 1 Declare a cash dividend on both common and preferred stock of $0.60 per share to all stockholders of record on June 15.

June 30 Pay the cash dividends declared on June 1.

August 1 Purchase 250 shares of common treasury stock for $14 per share.

October 1 Reissue 150 shares of treasury stock purchased on August 1 for $16 per share.

Nautical has the following beginning balances in its stockholders’ equity accounts on January 1, 2018:

Preferred Stock, $1,500;

Common Stock, $2,200;

Additional Paid-in Capital, $18,700; and Retained Earnings, $10,700.

Net income for the year ended December 31, 2018, is $7,250.

Required:

a) Record each of these transactions.

Answers: 3

Another question on Business

Business, 22.06.2019 14:30

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 15:40

Acompany manufactures x units of product a and y units of product b, on two machines, i and ii. it has been determined that the company will realize a profit of $3 on each unit of product a and $4 on each unit of product b. to manufacture a unit of product a requires 7 min on machine i and 5 min on machine ii. to manufacture a unit of product b requires 8 min on mchine i and 5 min on machine ii. there are 175 min available on machine i and 125 min available on machine ii in each work shift. how many units of a product should be produced in each shift to maximize the company's profit p?

Answers: 2

Business, 22.06.2019 20:10

Mikkelson corporation's stock had a required return of 12.50% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. then an increase in investor risk aversion caused the market risk premium to rise by 2%. the risk-free rate and the firm's beta remain unchanged. what is the company's new required rate of return? (hint: first calculate the beta, then find the required return.) do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 20:30

When many scrum teams are working on the same product, should all of their increments be integrated every sprint?

Answers: 3

You know the right answer?

Nautical has two classes of stock authorized: $10 par preferred, and $1 par value common. As of the...

Questions

Mathematics, 20.07.2019 09:50

History, 20.07.2019 09:50

Mathematics, 20.07.2019 09:50

Biology, 20.07.2019 09:50

Mathematics, 20.07.2019 09:50

Mathematics, 20.07.2019 09:50

Mathematics, 20.07.2019 09:50

Biology, 20.07.2019 09:50

Mathematics, 20.07.2019 09:50

Mathematics, 20.07.2019 09:50

Mathematics, 20.07.2019 09:50