Business, 05.05.2020 16:42 andrespacheco5888

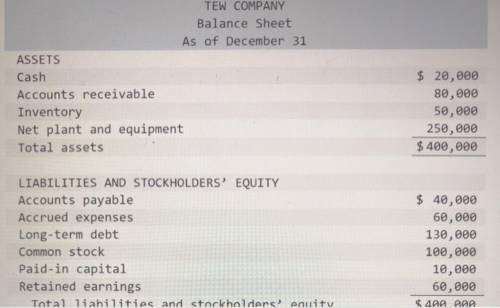

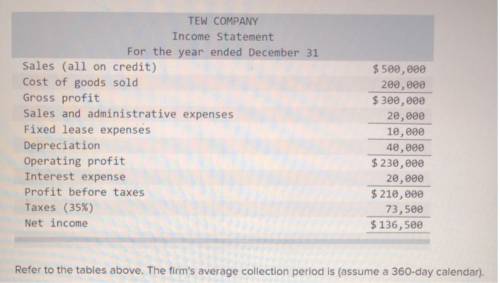

MARNI COMPANY Balance Sheet As of December 31 ASSETS Cash $ 50,000 Accounts receivable 100,000 Inventory 200,000 Net plant and equipment 650,000 Total assets $ 1,000,000 LIABILITIES AND STOCKHOLDERS’ EQUITY Accounts payable $ 100,000 Accrued expenses 90,000 Long-term debt 250,000 Common stock 100,000 Paid-in capital 50,000 Retained earnings 410,000 Total liabilities and stockholders’ equity $ 1,000,000 MARNI COMPANY Income Statement For the year ended December 31 Sales (all on credit) $ 2,000,000 Cost of goods sold 1,750,000 Gross profit $ 250,000 Sales and administrative expenses 30,000 Fixed lease expenses 10,000 Depreciation 60,000 Operating profit $ 150,000 Interest expense 25,000 Profit before taxes $ 125,000 Taxes (40%) 50,000 Net income $ 75,000 Refer to the tables above. The firm's average collection period is, assuming a 360-day calendar. 5.6 days. 20 days. 277 days. 18 days.

Answers: 2

Another question on Business

Business, 21.06.2019 22:00

How would you cite different books by the same author on the works cited page? a. moore, jack h. folk songs and ballads. salem: poetry press, 1999. print. moore, jack h. ballads in poetry – a critical review. dallas: garden books, 1962. print. b. moore, jack h. folk songs and ballads. salem: poetry press, 1999. print. –––. ballads in poetry – a critical review. dallas: garden books, 1962. print. c. moore, jack h. ballads in poetry – a critical review. dallas: garden books, 1962. print. moore, jack h. folk songs and ballads. salem: poetry press, 1999. print. d. moore, jack h. ballads in poetry – a critical review. dallas: garden books, 1962. print. –––. folk songs and ballads. salem: poetry press, 1999. print.

Answers: 1

Business, 22.06.2019 06:30

Selected data for stick’s design are given as of december 31, year 1 and year 2 (rounded to the nearest hundredth). year 2 year 1 net credit sales $25,000 $30,000 cost of goods sold 16,000 18,000 net income 2,000 2,800 cash 5,000 900 accounts receivable 3,000 2,000 inventory 2,000 3,600 current liabilities 6,000 5,000 compute the following: 1. current ratio for year 2 2. acid-test ratio for year 2 3. accounts receivable turnover for year 2 4. average collection period for year 2 5. inventory turnover for year 2

Answers: 2

Business, 22.06.2019 08:00

Companies in the u.s. car rental market vary greatly in terms of the size of the fleet, the number of locations, and annual revenue. in 2011 hertz had 320,000 cars in service and annual revenue of approximately $4.2 billion. the following data show the number of cars in service (1000s) and the annual revenue ($ millions) for six smaller car rental companies (auto rental news website, august 7, 2012). excel file: data14-09.xls if required, enter negative values as negative numbers. a. select a scatter diagram with the number of cars in service as the independent variable. b. what does the scatter diagram developed in part (a) indicate about the relationship between the two variables? c. use the least squares method to develop the estimated regression equation (to 3 decimals). ŷ = + x d. for every additional car placed in service, estimate how much annual revenue will change. by $ e. fox rent a car has 11,000 cars in service. use the estimated regression equation developed in part (c) to predict annual revenue for fox rent a car. round your answer to nearest whole value. $ million hide feedback partially correct

Answers: 1

Business, 22.06.2019 17:30

What is one counter argument to the premise that the wealth gap is a serious problem which needs to be addressed?

Answers: 1

You know the right answer?

MARNI COMPANY Balance Sheet As of December 31 ASSETS Cash $ 50,000 Accounts receivable 100,000 Inven...

Questions

Social Studies, 14.10.2019 23:00

Mathematics, 14.10.2019 23:00

Mathematics, 14.10.2019 23:00

History, 14.10.2019 23:00

English, 14.10.2019 23:00

Mathematics, 14.10.2019 23:00

English, 14.10.2019 23:00

Mathematics, 14.10.2019 23:00