Business, 24.02.2020 19:56 mendezmarco2004

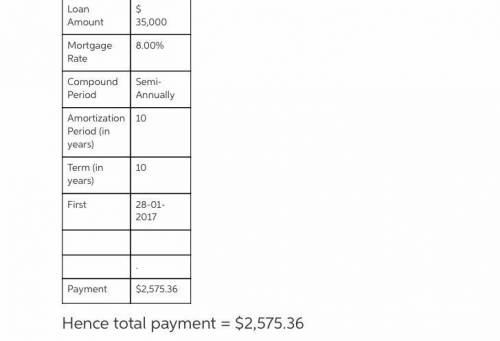

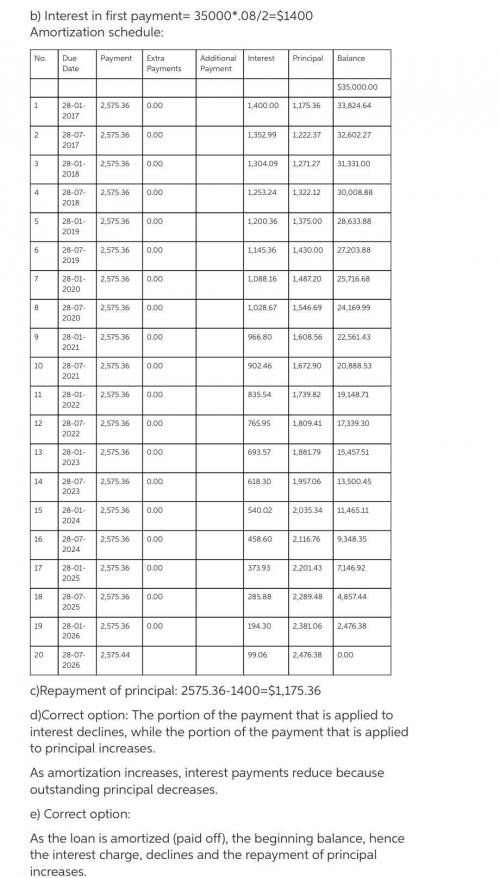

Jan sold her house on December 31 and took a $35,000 mortgage as part of the payment. The 10-year mortgage has a 8% nominal interest rate, but it calls for semiannual payments beginning next June 30. Next year Jan must report on Schedule B of her IRS Form 1040 the amount of interest that was included in the two payments she received during the year.

a. What is the dollar amount of each payment Jan receives? Round your answer to the nearest cent.

b. How much interest was included in the first payment? Round your answer to the nearest cent.

c. How much repayment of principal was included? Round your answer to the nearest cent.

d. How do these values change for the second payment?

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

Maker-bot corporation has 10,000 shares of 10%, $90 par value, cumulative preferred stock outstanding since its inception. no dividends were declared in the first two years. if the company pays $400,000 of dividends in the third year, how much will common stockholders receive?

Answers: 2

Business, 22.06.2019 12:00

Describe the three different ways the argument section of a cover letter can be formatted

Answers: 1

Business, 22.06.2019 15:20

Record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. the allowance for doubtful accounts before adjustment has a credit balance of $500. b. the allowance for doubtful accounts before adjustment has a debit balance of $250. c. assume that octoberʼs credit sales were $70,000. uncollectible accounts expense is estimated at 2% of sales. smith, gaylord n.. excel applications for accounting principles (p. 51). cengage textbook. kindle edition.

Answers: 1

Business, 22.06.2019 19:40

The following cost and inventory data are taken from the accounting records of mason company for the year just completed: costs incurred: direct labor cost $ 90,000 purchases of raw materials $ 134,000 manufacturing overhead $ 205,000 advertising expense $ 45,000 sales salaries $ 101,000 depreciation, office equipment $ 225,000 beginning of the year end of the year inventories: raw materials $ 8,100 $ 10,300 work in process $ 5,900 $ 21,000 finished goods $ 77,000 $ 25,800 required: 1. prepare a schedule of cost of goods manufactured. 2. prepare the cost of goods sold section of mason company’s income statement for the year.

Answers: 3

You know the right answer?

Jan sold her house on December 31 and took a $35,000 mortgage as part of the payment. The 10-year mo...

Questions

Mathematics, 02.07.2019 21:30

Mathematics, 02.07.2019 21:30

Chemistry, 02.07.2019 21:30

Social Studies, 02.07.2019 21:30

Chemistry, 02.07.2019 21:30

Social Studies, 02.07.2019 21:30

Mathematics, 02.07.2019 21:30

Mathematics, 02.07.2019 21:30

Mathematics, 02.07.2019 21:30

History, 02.07.2019 21:30

Mathematics, 02.07.2019 21:30

Advanced Placement (AP), 02.07.2019 21:30