Business, 18.12.2019 04:31 JaylenGuidish

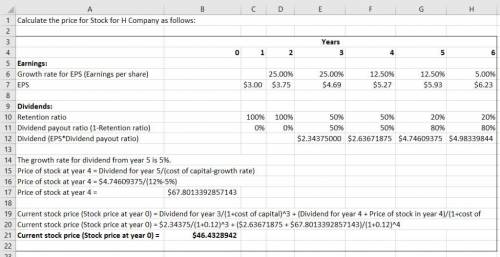

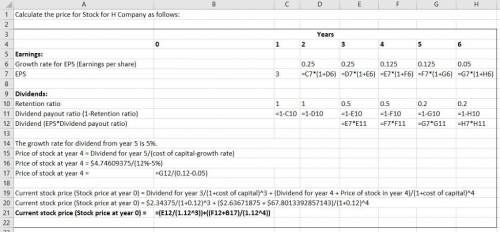

Halliford corporation expects to have earnings this coming year of $3/share. halliford plans to retain all of its earnings for the next two years. then, for the subsequent two years, the firm will retain 50% of its earnings. it will retain 20% of its earnings from that point onward. each year, retianed earnings will be invested in new projects with an expected return of 25% per year. any earnings that are not retained will be paid out as dividends. assume halliford's share count remains constant and all earnings growth comes from the investment of retained earnings. if halliford's equity cost of capital is 12 percent, what price would you estimate for halliford stock in years 0,1, and 2?

Answers: 2

Another question on Business

Business, 22.06.2019 09:40

Wilson center is a private not-for-profit voluntary health and welfare entity. during 2017, it received unrestricted pledges of $638,000, 65 percent of which were payable in 2017, with the remainder payable in 2018 (for use in 2018). officials estimate that 14 percent of all pledges will be uncollectible. a. how much should wilson center report as contribution revenue for 2017? b. in addition, a local social worker, earning $20 per hour working for the state government, contributed 600 hours of time to wilson center at no charge. without these donated services, the organization would have hired an additional staff person. how should wilson center record the contributed service?

Answers: 2

Business, 22.06.2019 13:20

Last year, johnson mills had annual revenue of $37,800, cost of goods sold of $23,200, and administrative expenses of $6,300. the firm paid $700 in dividends and had a tax rate of 35 percent. the firm added $2,810 to retained earnings. the firm had no long-term debt. what was the depreciation expense?

Answers: 2

Business, 22.06.2019 14:50

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

Business, 22.06.2019 19:30

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

You know the right answer?

Halliford corporation expects to have earnings this coming year of $3/share. halliford plans to reta...

Questions

Health, 09.10.2019 08:50

History, 09.10.2019 08:50

Spanish, 09.10.2019 08:50

Chemistry, 09.10.2019 08:50

Biology, 09.10.2019 08:50

Mathematics, 09.10.2019 08:50

Mathematics, 09.10.2019 08:50

Computers and Technology, 09.10.2019 08:50

Mathematics, 09.10.2019 08:50

Health, 09.10.2019 08:50