Business, 03.12.2019 01:31 allisonzawodny3533

On january 1, 2017, bensen company leased equipment to flynn corporation. the following information pertains to this lease.

the term of the non-cancelable lease is 6 years. at the end of the lease term, flynn has the option to purchase the equipment for $1,000, while the expected residual value at the end of the lease is $5,000.

equal rental payments are due on january 1 of each year, beginning in 2017.

the fair value of the equipment on january 1, 2017, is $150,000, and its cost is $120,000.

the equipment has an economic life of 8 years. flynn depreciates all of its equipment on a straight-line basis.

bensen set the annual rental to ensure a 5% rate of return. flynn's incremental borrowing rate is 6%, and the implicit rate of the lessor is unknown.

collectibility of lease payments by the lessor is probable. (both the lessor and the lessee's accounting periods end on december 31.)

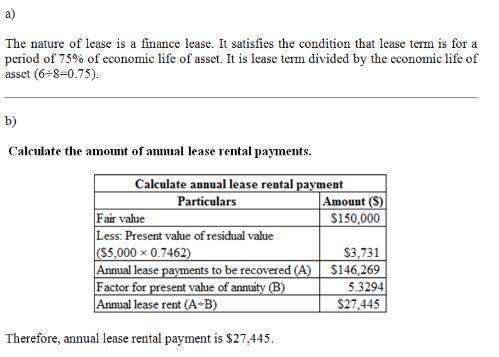

(a) discuss the nature of this lease to bensen and flynn.

(b) calculate the amount of the annual rental payment.

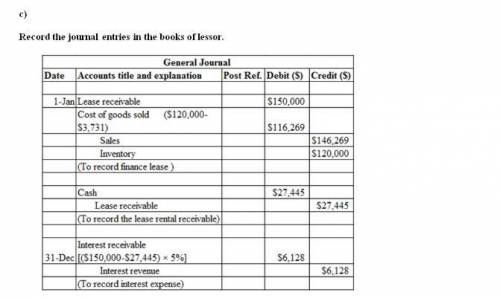

(c) prepare all the necessary journal entries for bensen for 2017.

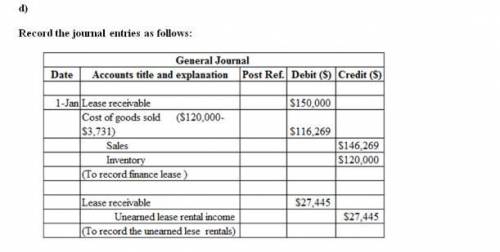

(d) suppose the collectibility of the lease payments was not probable for bensen. prepare all necessary journal entries for the company in 2017.

(e) prepare all the necessary journal entries for flynn for 2017.

(f) discuss the effect on the journal entry for flynn at lease commencement, assuming initial direct costs of $2,000 are incurred by flynn to negotiate the lease.

Answers: 3

Another question on Business

Business, 22.06.2019 22:30

Ellen and george work for the same company. ellen, a gen xer, really appreciates the flextime opportunities, while george, a baby boomer, takes advantage of the free computer training offered at the company. these policies are examples of

Answers: 3

Business, 23.06.2019 07:50

Tubby toys estimates that its new line of rubber ducks will generate sales of $7.60 million, operating costs of $4.60 million, and a depreciation expense of $1.60 million. if the tax rate is 35%, what is the firm’s operating cash flow? (enter your answer in millions rounded to 2 decimal places.)

Answers: 1

Business, 23.06.2019 13:30

Which tasks do travel agents and hotel concierges have in common? they both recommend where to eat and handle personal services for tourists. they both process payments and book travel packages for tourists. they both make reservations and provide information for tourists. they both recommend unusual spots to visit and book tour guides for tourists

Answers: 2

Business, 23.06.2019 19:30

You are offered a free ticket to see the chicago cubs play the chicago white sox at wrigley field. assume the ticket has no resale value. willie nelson is performing on the same night, and his concert is your next-best alternative activity. tickets to see willie nelson cost $40. on any given day, you would be willing to pay up to $50 to see and hear willie nelson perform. assume there are no other costs of seeing either event. based on this information, at a minimum, how much would you have to value seeing the cubs play the white sox to accept the ticket and go to the game? a. $0b. $40c. $10d. $50

Answers: 1

You know the right answer?

On january 1, 2017, bensen company leased equipment to flynn corporation. the following information...

Questions

Biology, 29.09.2019 19:50

Mathematics, 29.09.2019 19:50

Mathematics, 29.09.2019 19:50

Health, 29.09.2019 19:50

Mathematics, 29.09.2019 19:50

Health, 29.09.2019 19:50

Mathematics, 29.09.2019 19:50

Mathematics, 29.09.2019 19:50

Social Studies, 29.09.2019 19:50

Mathematics, 29.09.2019 19:50

History, 29.09.2019 19:50

Mathematics, 29.09.2019 19:50