Business, 16.09.2019 17:30 brutalgitaffe

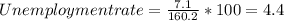

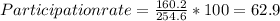

In april 2017, the working-age population of the united states was 254.6 million. the working-age population is divided into those in the labor force (160.2 million) and those not in the labor force (94.4 million). the labor force is divided into the employed (153.2 million) and the unemployed (7.1 million). those not in the labor force are divided into those not available for work (88.7 million) and those available for work (5.7 million). finally, those available for work but not in the labor force are divided into discouraged workers (0.5 million) and those currently not working for other reasons (5.2 million). use this data to determine which one of the following statements is true: a. the unemployment rate is startfraction 7.1 million over 160.2 million endfraction times 100 equals 4.4 % . b. the labor force participation rate is startfraction 160.2 million over 254.6 million endfraction times 100 equals 62.9 % . c. the labor force is 254.6 million. d. both a and b above are true.

Answers: 3

Another question on Business

Business, 21.06.2019 17:10

All else being equal, which is true about a firm with high operating leverage relative to a firm with low operating leverage? select one: a. a higher percentage of the high operating leverage firm's costs are fixed. b. the high operating leverage firm is exposed to less risk. c. the debt payments limit the high operating leverage firm's opportunities to turn a big profit. d. the high operating leverage firm has more debt.

Answers: 2

Business, 21.06.2019 21:00

Accublade castings inc. casts blades for turbine engines. within the casting department, alloy is first melted in a crucible, then poured into molds to produce the castings. on may 1, there were 230 pounds of alloy in process, which were 60% complete as to conversion. the work in process balance for these 230 pounds was $32,844, determined as follows: exercises during may, the casting department was charged $350,000 for 2,500 pounds of alloy and $19,840 for direct labor. factory overhead is applied to the department at a rate of 150% of direct labor. the department transferred out 2,530 pounds of finished castings to the machining department. the may 31 inventory in process was 44% complete as to conversion. prepare the following may journal entries for the casting department: the materials charged to production the conversion costs charged to production the completed production transferred to the machining department determine the work in process"casting department may 31 balance.

Answers: 1

Business, 21.06.2019 22:30

The blank is type of decision-maker who over analyzes information

Answers: 1

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

You know the right answer?

In april 2017, the working-age population of the united states was 254.6 million. the working-age po...

Questions

Mathematics, 19.09.2019 03:30

Biology, 19.09.2019 03:30

History, 19.09.2019 03:30

Chemistry, 19.09.2019 03:30

Mathematics, 19.09.2019 03:30

Mathematics, 19.09.2019 03:30

Biology, 19.09.2019 03:30

English, 19.09.2019 03:30

Mathematics, 19.09.2019 03:30

Biology, 19.09.2019 03:30

Mathematics, 19.09.2019 03:30

Mathematics, 19.09.2019 03:30

Computers and Technology, 19.09.2019 03:30