Mathematics, 27.01.2020 21:31 lordcaos066

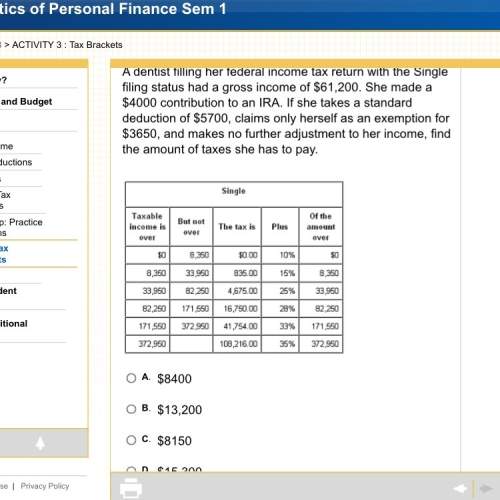

Adentist filling her federal income tax return with the single filing status had a gross income of $61,200. she made a $4000 contribution to an ira. if she takes a standard deduction of $5700, claims only herself as an exemption for $3650, and makes no further adjustment to her income, find the amount of taxes she has to pay.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Acircular garden with radius of 8 feet is surrounded by a circular path with a width of 3 feet. what is the approximate area of the path alone? use 3.14 for π

Answers: 3

Mathematics, 21.06.2019 19:30

Plz.yesterday, the snow was 2 feet deep in front of archie’s house. today, the snow depth dropped to 1.6 feet because the day is so warm. what is the percent change in the depth of the snow?

Answers: 1

Mathematics, 21.06.2019 21:00

The zoo collects $9.60 for every 24 tickets sold. how much will be collected for 400 tickets?

Answers: 2

Mathematics, 22.06.2019 00:50

Asource of laser light sends rays ab and ac toward two opposite walls of a hall. the light rays strike the walls at points b and c, as shown below: what is the distance between the walls?

Answers: 2

You know the right answer?

Adentist filling her federal income tax return with the single filing status had a gross income of $...

Questions

Mathematics, 21.10.2020 21:01

Chemistry, 21.10.2020 21:01

Mathematics, 21.10.2020 21:01

Mathematics, 21.10.2020 21:01

Computers and Technology, 21.10.2020 21:01

Mathematics, 21.10.2020 21:01

Biology, 21.10.2020 21:01

Mathematics, 21.10.2020 21:01