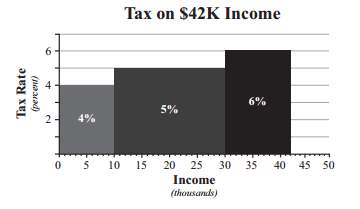

In alaya’s home state, an individual’s income tax is calculated as follows:

• 4% on any porti...

Mathematics, 29.11.2019 07:31 lizzyhearts

In alaya’s home state, an individual’s income tax is calculated as follows:

• 4% on any portion of income less than or equal to $10,000, plus

• 5% on any portion of income greater than $10,000 but less than or

equal to $30,000, plus

• 6% on any portion of income over $30,000.

the figure shows how the state income tax is calculated for an income of

$42,000. if alaya paid $3200 in state income tax, what was his income?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 19:20

The square root of 9x plus 7 plus the square rot of 2x equall to 7

Answers: 1

Mathematics, 21.06.2019 22:10

Which function can be used to model the monthly profit for x trinkets produced? f(x) = –4(x – 50)(x – 250) f(x) = (x – 50)(x – 250) f(x) = 28(x + 50)(x + 250) f(x) = (x + 50)(x + 250)

Answers: 2

Mathematics, 22.06.2019 02:30

Anne plans to increase the prices of all the items in her store by 5%. to the nearest cent, how much will an artist save if the artist buys a canvas and a frame that each measure 24 by 36 inches before the price increase goes into effect?

Answers: 1

You know the right answer?

Questions

Mathematics, 03.09.2020 06:01

Mathematics, 03.09.2020 06:01

Geography, 03.09.2020 06:01

English, 03.09.2020 06:01

Physics, 03.09.2020 06:01

English, 03.09.2020 06:01