Mathematics, 06.11.2019 10:31 cgarnett5408

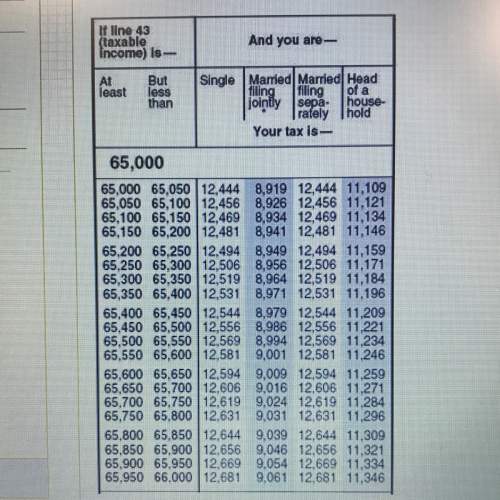

Gregory’s taxable income last year was $65,750. according to the tax table below, how much tax does he have to pay if he files with the “single” status? a.) $9,024 b.) $9,031 c.) $12,631 d.) $12,619

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 14:30

F(x)= 1/x-4, g(x)=4x+1/x a. use composition to prove whether or not the functions are inverses of each other. b. express the domain of the compositions using interval notation.

Answers: 2

Mathematics, 21.06.2019 20:00

Given ab and cb are tangents of p, and m =10°. what is the measure of abp?

Answers: 3

Mathematics, 22.06.2019 01:00

In each diagram, line p is parallel to line f, and line t intersects lines p and f. based on the diagram, what is the value of x? ( provide explanation)

Answers: 1

Mathematics, 22.06.2019 02:50

Atourist boat is used for sightseeing in a nearby river. the boat travels 2.4 miles downstream and in the same amount of time, it travels 1.8 miles upstream. if the boat travels at an average speed of 21 miles per hour in the still water, find the current of the river.

Answers: 2

You know the right answer?

Gregory’s taxable income last year was $65,750. according to the tax table below, how much tax does...

Questions

Biology, 28.07.2019 20:30

Chemistry, 28.07.2019 20:30

Mathematics, 28.07.2019 20:30

Mathematics, 28.07.2019 20:30