Mathematics, 12.07.2019 15:40 Osmin

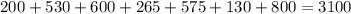

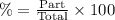

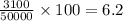

Alender estimates the closing costs on a home loan of $50,000 as listed below. closing cost charge loan origination $200 title insurance $530 attorney’s fees $600 appraisal $265 inspection $575 recording fees $130 escrow $800 if the lender's good faith estimates are accurate, are they a reasonable amount for closing costs? why or why not? a. yes, because the lender esitmated 3.08% of the home loan in closing costs which falls between 3 - 5%. b. yes, because the lender estimated 4.6% of the home loan in closing costs which does not fall between 3 - 5%. c. no, because the lender estimated 6.2% of the home loan in closing costs which does not fall between 3 - 5%. d. no, because the lender estimated 17.7% of the home loan in closing costs which does fall between 3 - 5%.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:30

Given: m∠ adb = m∠cdb ad ≅ dc prove: m∠ bac = m∠bca lol

Answers: 2

Mathematics, 21.06.2019 20:30

The areas of two similar triangles are 72dm2 and 50dm2. the sum of their perimeters is 226dm. what is the perimeter of each of these triangles?

Answers: 1

Mathematics, 22.06.2019 00:00

When rolling 26 sided number cube what are the chances some of the role will be seven

Answers: 1

Mathematics, 22.06.2019 00:30

You eat $0.85 for every cup of hot chocolate you sell. how many cups do you need to sell to earn $55.25

Answers: 2

You know the right answer?

Alender estimates the closing costs on a home loan of $50,000 as listed below. closing cost charge l...

Questions

English, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

Social Studies, 16.04.2021 01:00

Geography, 16.04.2021 01:00