Mathematics, 05.07.2019 02:30 shanicar33500

Your gross weekly salary is $800.00. your federal income tax deduction is $53. the social security tax is 6.2%. the medicare tax is 1.45% of gross pay. the state tax is 1.5% of gross pay. each week you have $28.40 deducted for medical insurance and $12.00 for a health savings account. what is your net pay?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 14:00

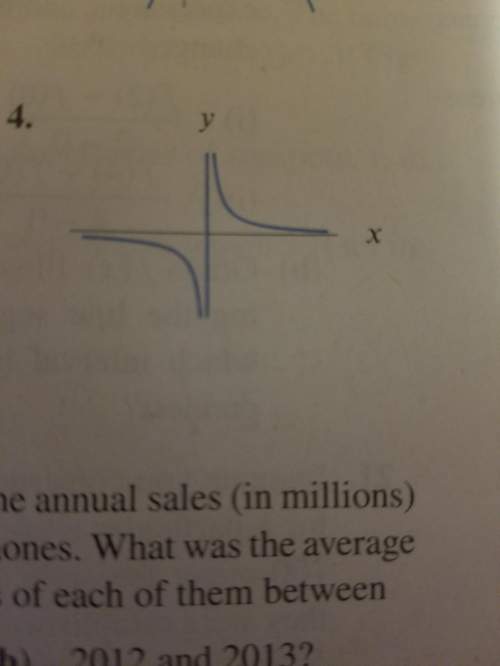

Which expression is equivalent to? assume x > 0 and y > 0.

Answers: 1

Mathematics, 21.06.2019 19:00

The weekly revenue for a company is r = 3p^2 + 60p + 1060, where p is the price of the company's product. what price will result in a revenue of $1200.

Answers: 1

Mathematics, 21.06.2019 20:50

Find the equation of a line that is perpendicular to line g that contains (p, q). coordinate plane with line g that passes through the points negative 3 comma 6 and 0 comma 5 3x − y = 3p − q 3x + y = q − 3p x − y = p − q x + y = q − p

Answers: 1

You know the right answer?

Your gross weekly salary is $800.00. your federal income tax deduction is $53. the social security t...

Questions

Mathematics, 30.11.2020 18:00

Mathematics, 30.11.2020 18:00

Biology, 30.11.2020 18:00

Mathematics, 30.11.2020 18:00