Mathematics, 03.07.2019 07:40 live4dramaoy0yf9

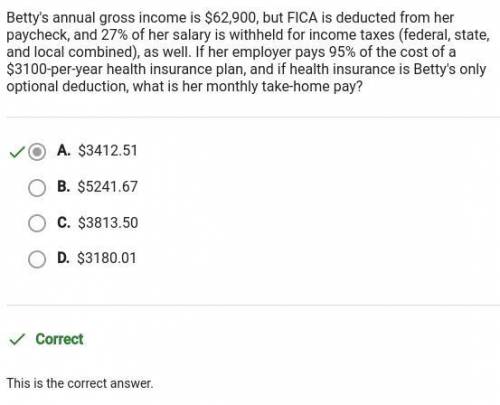

Betty's annual gross income is $62,900, but fica is deducted from her paycheck, and 27% of her salary is withheld for income taxes (federal, state, and local combined), as well. if her employer pays 95% of the cost of a $3100-per-year health insurance plan, and if health insurance is betty's only optional deduction, what is her monthly take-home pay?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 22:00

Let event a = you roll an even number on the first cube.let event b = you roll a 6 on the second cube.are the events independent or dependent? why?

Answers: 1

Mathematics, 21.06.2019 23:30

Alex's monthly take home pay is $2,500. what is the maximum bad debt payment he can maintain without being in credit overload?

Answers: 2

You know the right answer?

Betty's annual gross income is $62,900, but fica is deducted from her paycheck, and 27% of her salar...

Questions

Mathematics, 27.09.2019 22:00

History, 27.09.2019 22:00

Biology, 27.09.2019 22:00

English, 27.09.2019 22:00

Biology, 27.09.2019 22:00

English, 27.09.2019 22:00

Biology, 27.09.2019 22:00

Mathematics, 27.09.2019 22:00

Biology, 27.09.2019 22:00

Biology, 27.09.2019 22:00

Social Studies, 27.09.2019 22:00

History, 27.09.2019 22:00