Mathematics, 07.04.2022 02:40 shradhwaip2426

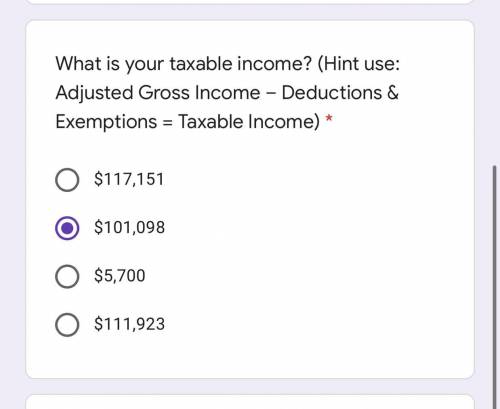

You have a gross income of $117,151 and are filing your tax return singly. You claim one exemption and can take a deduction of $2,713 for interest on your mortgage, an adjustment of $2,791 for business losses, an adjustment of $1,346 for alimony, a deduction of $2,086 for property taxes, a deduction of $2,376 for contributions to charity, and an adjustment of $1,091 for contributions to your retirement fund. The standard deduction for a single filer is $5,700, and exemptions are each worth $3,650.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:30

Adriver from the university of florida women’s swimming and diving team is competing in the in ncaa zone b championships

Answers: 3

Mathematics, 21.06.2019 19:00

What is the expression in factored form? 3x^2 + 18x + 24 a. 3(x+2)(x+4) b. 3(x-2)(x+4) c. 3(x-2)(x-4) d. 3(x+2)(x-4)

Answers: 2

Mathematics, 21.06.2019 21:00

Which expression is equivalent to 16 in exponential form? a) 4 × 4 b) 8 × 2 c) 23 d) 24

Answers: 2

Mathematics, 21.06.2019 22:30

The area of a circle is equal to 1 dm². find the radius of the circle.

Answers: 1

You know the right answer?

You have a gross income of $117,151 and are filing your tax return singly. You claim one exemption a...

Questions

Geography, 16.11.2020 16:30

Mathematics, 16.11.2020 16:30

Mathematics, 16.11.2020 16:30