Mathematics, 12.03.2022 15:40 ilovebeanieboos

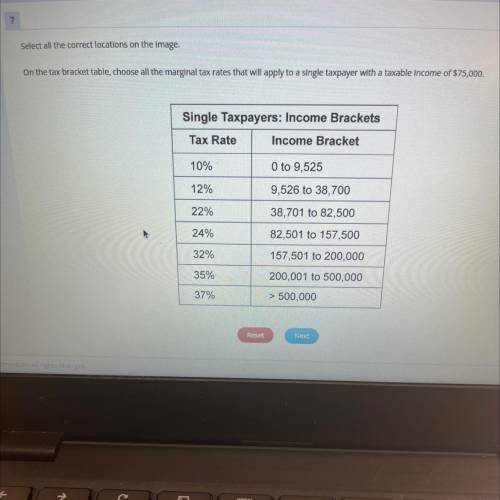

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer with a taxable income of $75,000.

Single Taxpayers: Income Brackets

Tax Rate

Income Bracket

10%

O to 9,525

12%

9,526 to 38,700

22%

38,701 to 82,500

24%

82,501 to 157,500

32%

157,501 to 200,000

35%

200,001 to 500,000

37%

> 500,000

Reset

Next

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 16:30

Ineed ! the person who answers and shows their work on they got the answer first will be marked the !

Answers: 1

Mathematics, 21.06.2019 18:30

Which equation represents the model shown? a)1/3 divide 1/6 = 2 b)2/3 divide 1/6 = 2/18 c)1/3 divide 1/6 = 1/18 d)2/3 divide 1/6 =4

Answers: 1

Mathematics, 22.06.2019 00:50

Answer asap. you begin with 1/2 scoop of ice cream. since you're hungry, you ask the vendor for 2/7 more scoops of ice cream. then, you eat 5/8 scoops. how many scoops of ice cream are left on your cone? i will mark brainliest for first correct answer.

Answers: 2

Mathematics, 22.06.2019 01:00

Jack is considering a list of features and fees for current bank: jack plans on using network atms about 4 times per month. what would be jack’s total estimated annual fees for a checking account with direct paycheck deposit, one overdraft per year, and no 2nd copies of statements? a. $44 b. $104 c. $144 d. $176

Answers: 1

You know the right answer?

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer wit...

Questions

Mathematics, 19.07.2019 12:00

History, 19.07.2019 12:00

Mathematics, 19.07.2019 12:00

Biology, 19.07.2019 12:00

Mathematics, 19.07.2019 12:00

Biology, 19.07.2019 12:00

Chemistry, 19.07.2019 12:00

Mathematics, 19.07.2019 12:00

Mathematics, 19.07.2019 12:00

History, 19.07.2019 12:00

English, 19.07.2019 12:00

Mathematics, 19.07.2019 12:00

Mathematics, 19.07.2019 12:00

Biology, 19.07.2019 12:00