Mathematics, 12.03.2022 14:00 juniorvalencia4

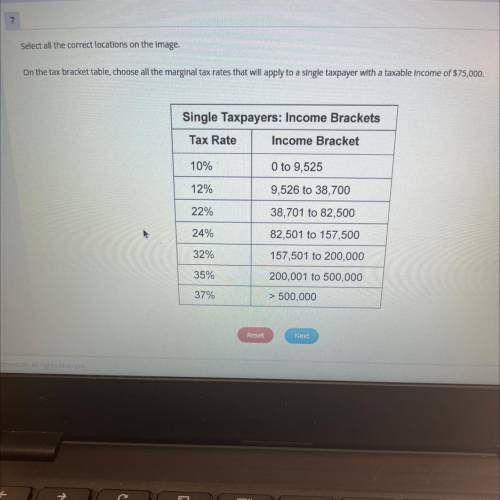

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer with a taxable income of $75,000.

Single Taxpayers: Income Brackets

Tax Rate

Income Bracket

10%

O to 9,525

12%

9,526 to 38,700

22%

38,701 to 82,500

24%

82,501 to 157,500

32%

157,501 to 200,000

35%

200,001 to 500,000

37%

> 500,000

Reset

Next

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:30

Strawberries cause two hours per pound kate buys 5 pounds he gets 20% off discount on the total cost how much does kate pay for the strawberries

Answers: 3

Mathematics, 21.06.2019 16:00

This race was first held in 1953 on august 16th. every decade the race finishes with a festival. how many years is this?

Answers: 2

Mathematics, 21.06.2019 17:30

Which expression can be used to determine the slope of the line that passes through the points -6, three and one, -9

Answers: 3

Mathematics, 21.06.2019 19:00

Eis the midpoint of line segment ac and bd also line segment ed is congruent to ec prove that line segment ae is congruent to line segment be

Answers: 3

You know the right answer?

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer wit...

Questions

Mathematics, 03.06.2020 13:20

History, 03.06.2020 13:20

History, 03.06.2020 13:20

Mathematics, 03.06.2020 13:20

Mathematics, 03.06.2020 13:20

Mathematics, 03.06.2020 13:20

English, 03.06.2020 13:20

History, 03.06.2020 13:20

Mathematics, 03.06.2020 13:20

History, 03.06.2020 13:20