Mathematics, 14.12.2021 09:40 meiyrarodriguez

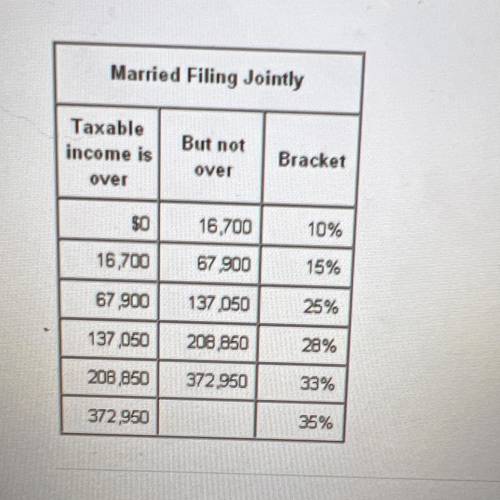

According to the table below, which of these is a possible taxable income for

a married couple filing jointly in the 28% federal income tax bracket?

Married Filing Jointly

But not

Taxable

income is

over

Bracket

over

$0

10%

16.700

67.900

16,700

15%

67 900

137,050

25%

137,050

208,850

28%

208,850

372,950

33%

372,950

35%

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:00

Answer this question, only if you know the answer. 30 points and brainliest!

Answers: 1

Mathematics, 21.06.2019 18:30

How do you determine whether a relationship represented as as graph is linear or nonlinear

Answers: 1

Mathematics, 21.06.2019 23:30

For the feasibility region shown below find the maximum value of the function p=3x+2y

Answers: 3

Mathematics, 22.06.2019 01:00

Mia’s gross pay is 2953 her deductions total 724.15 what percent if her gross pay is take-home pay

Answers: 1

You know the right answer?

According to the table below, which of these is a possible taxable income for

a married couple fil...

Questions

History, 01.05.2021 02:10

Mathematics, 01.05.2021 02:10

Mathematics, 01.05.2021 02:10

Social Studies, 01.05.2021 02:10

Mathematics, 01.05.2021 02:10

History, 01.05.2021 02:10

History, 01.05.2021 02:10

Computers and Technology, 01.05.2021 02:10

Mathematics, 01.05.2021 02:10