Mathematics, 23.09.2021 09:30 lildanielmabien

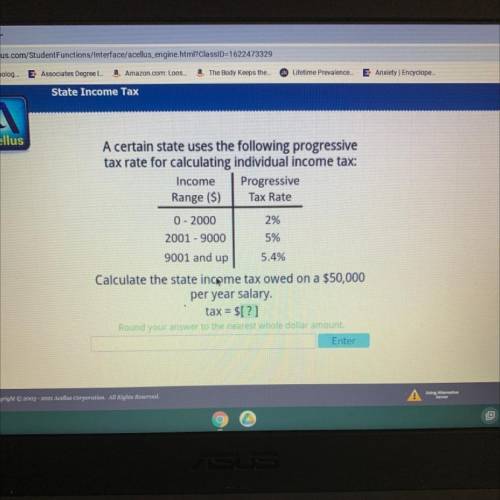

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up 5.4%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount,

Enter

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 19:20

Brainliest ! which of the coordinates are not of th vertices of the feasible region for the system of inequalities y≤4,,x≤5,x+y> 6 a(2,4) b(0,6) c(5,4) d(5,1)

Answers: 2

Mathematics, 21.06.2019 21:00

Hurry if the population of of an ant hill doubles every 10 days and there are currently 100 ants living in the ant hill what will the ant population be in 20 days

Answers: 2

Mathematics, 21.06.2019 22:00

Acaterer charges $500 plus $30 per guest to cater a wedding. walt and traci don't want to spend more than $8000 on catering. write and solve an inequality in terms of the number of guests, g, that can be invited. a) 30g ? 8000; g ? 267 b) 500g < 8000; g < 16 c) 500 + 30g < 8000; g < 250 d) 500 + 30g ? 8000; g ? 250

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 04.06.2020 23:00

Mathematics, 04.06.2020 23:00

Mathematics, 04.06.2020 23:00

English, 04.06.2020 23:00

English, 04.06.2020 23:00

Mathematics, 04.06.2020 23:00

English, 04.06.2020 23:00

Mathematics, 04.06.2020 23:00

Mathematics, 04.06.2020 23:00