Mathematics, 20.05.2021 05:20 blakemtyy

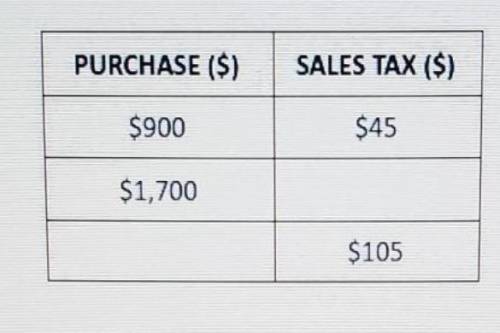

In the state of Wisconsin, the sales tax on purchased items is a fixed percent rate of 5%. The table below shows a sales tax for a purchase of $900.

PART A Determine the sale tax ($) for a $1,700 purchase. Use the sales tax percent of 5%. Use the appropriate equation or your own percent method to explain your work.

part b : determine the purchase amount of the sales tax ($) is $ 105. use the sales tax percent of 5%. Use the appropriate equation or your own percent method to explain your work.

part c. your classmate says that the sales tax percentage rate is 20% because 900 ÷45=20 state whether you agree or disagree with your classmates reasoning and use mathematics to explain your answer

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Drag the tiles to the correct boxes to complete the pairs. match the cart-coordinates with their corresponding pairs of y-coordinates of the unit circle

Answers: 3

Mathematics, 21.06.2019 19:00

Gh bisects fgi. find the measure of hgi •15° •21° •10° •8°

Answers: 2

Mathematics, 21.06.2019 20:30

The cost for an uberi is $2.50 plus $2.00 mile. if the total for the uber ride was $32.50, how many miles did the customer travel?

Answers: 3

Mathematics, 22.06.2019 02:00

Acompound inequality is graphed, and its graph consists of all real numbers. which open scentence could have resulted in this solution set r> 3 or r< -2. r< 3 or r< -2. r> 3 or r> -2. r< 3 or r> -2 plz asap

Answers: 1

You know the right answer?

In the state of Wisconsin, the sales tax on purchased items is a fixed percent rate of 5%. The table...

Questions

Business, 02.09.2021 14:00

Chemistry, 02.09.2021 14:00

Mathematics, 02.09.2021 14:00

Social Studies, 02.09.2021 14:00

Biology, 02.09.2021 14:00

History, 02.09.2021 14:00

English, 02.09.2021 14:00

Mathematics, 02.09.2021 14:00