Mathematics, 05.05.2021 08:10 WonTonBagel

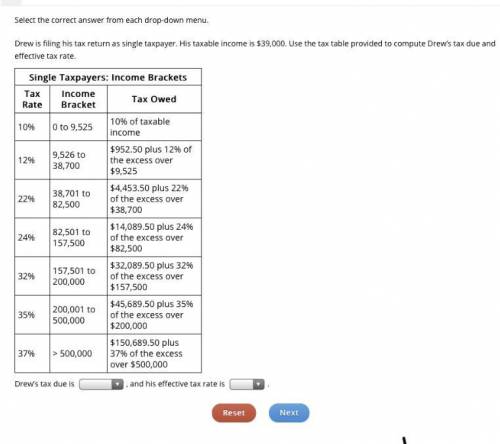

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table provided to compute Drew’s tax due and effective tax rate

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:30

Scrub a dub toothbrushes are $4.00 each. there is a 10% discount, but there is also a 6% sales tax after the discount is applied. what is the new price after tax? round to the nearest penny

Answers: 1

Mathematics, 22.06.2019 00:20

Acircle has a radius of 12.6cm what is the exact length of an arc formed by a central angle measuring 120

Answers: 1

Mathematics, 22.06.2019 01:00

Leslie started last week with $1200 in her checking account. during the week, she wrote the checks below. trans typ./ check no. date description of transaction payment/ debit deposit/ credit (+) balance 1,200 00 324 10/6 miller's food market 45.87 45 87 groceries 1,154 13 325 10/7 cyber center computer outlet 218.59 218 59 monitor 935 54 326 10/9 sandy's beauty salon 30.00 30 00 haircut and styling 900 59 deposit 10/10 paycheck 621.33 621 33 1,621 92 evaluate leslie's check register. a. leslie did a good job. everything is correct. b. the final balance is wrong; she did not add everything correctly. c. leslie should have written debit instead of deposit for the transaction type. d. leslie switched the debit and credit columns.

Answers: 2

You know the right answer?

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table p...

Questions

Mathematics, 01.02.2021 17:20

Chemistry, 01.02.2021 17:20

Mathematics, 01.02.2021 17:20

Mathematics, 01.02.2021 17:20

Mathematics, 01.02.2021 17:20

Mathematics, 01.02.2021 17:20

Social Studies, 01.02.2021 17:20

Computers and Technology, 01.02.2021 17:20

Mathematics, 01.02.2021 17:20