Mathematics, 09.01.2020 12:31 jself

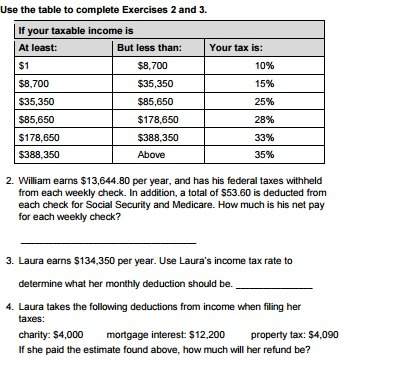

1. william earns $134,644.80 per year, and has his federal taxes withheld from each weekly check. in addition, a total of $53.60 is deducted from each check from each social security and medicare. how much is his net pay from each weekly check?

2. laura earns 134,350 per year. use laura's income tax rate to determine what her monthly deduction should be.

3. laura takes the following deductions from income when filling her taxes:

charity: $4,000 mortage interest: $12,200 property tax: $4,090

if she paued the estimate found above, how much will her refund be?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 23:20

In the diagram below,abc is congruent to dec what is the value of x

Answers: 2

Mathematics, 21.06.2019 23:30

Atown has a population of 12000 and grows at 3.5% every year. what will be the population after 7 years, to the nearest whole number?

Answers: 3

Mathematics, 22.06.2019 02:40

Jenny made a scale drawing of a city. the scale she used was 5 inches = 1 yard. what is the scale factor of the drawing?

Answers: 3

Mathematics, 22.06.2019 03:30

Adie is rolled, what is the probability of getting an even number or a 3? write the solution too

Answers: 1

You know the right answer?

1. william earns $134,644.80 per year, and has his federal taxes withheld from each weekly check. in...

Questions

Mathematics, 10.10.2019 04:10

Mathematics, 10.10.2019 04:10

English, 10.10.2019 04:10

Mathematics, 10.10.2019 04:10

English, 10.10.2019 04:10

Mathematics, 10.10.2019 04:10