Mathematics, 26.08.2019 23:00 evazquez

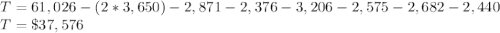

Say you are filing as a single taxpayer. you have a gross income of $61,026 and claim two exemptions. you can make a deduction of $2,871 for interest on your mortgage, a deduction of $2,376 for property tax, an adjustment of $3,206 for business losses, an adjustment of $2,575 for contributions to your retirement plan, a deduction of $2,682 for medical expenses, and an adjustment of $2,440 for business expenses. if exemptions are each worth $3,650 and the standard deduction is $5,700, what is your total taxable income?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:50

Which is a true statement about an exterior angle of a triangle a. it is formed by two segments that are not sides of the triangle, b. it forms a linear pair with one of the interior angles of the triangle, c. it is complementary to one of the interior angles of the triangle. d. it is formed by two segments that are sides of the triangle.

Answers: 2

Mathematics, 21.06.2019 17:00

Acar travels at an average speed of 56 miles per hour. how long does it take to travel 196 miles

Answers: 1

Mathematics, 21.06.2019 19:00

45% of the trees in a park are apple trees. there are 27 apple trees in the park. how many trees are in the park in all?

Answers: 1

Mathematics, 22.06.2019 02:30

F(x) = 2x + 1? h(x) = x – h(x) = x + h(x) = x – 2 h(x) = x + 2

Answers: 2

You know the right answer?

Say you are filing as a single taxpayer. you have a gross income of $61,026 and claim two exemptions...

Questions

Biology, 24.07.2019 16:50

History, 24.07.2019 16:50

Mathematics, 24.07.2019 16:50

Mathematics, 24.07.2019 16:50

Biology, 24.07.2019 16:50

Biology, 24.07.2019 16:50

History, 24.07.2019 16:50

History, 24.07.2019 16:50

Health, 24.07.2019 16:50