Mathematics, 19.04.2021 20:30 beausisugpula

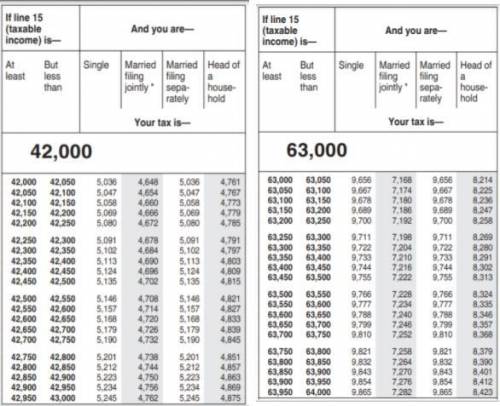

Use the tax tables to determine the tax for the given filing status and taxable income amount:

Head of Household $63,572: $

Single $42,921: $

Married Filing Jointly $42,051: $

Married Filing Separately $63,999: $

Type the numbers with no $ sign and no decimals.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:30

Iwill make brain if you me correctly fill this out needs due today pls and send it back to me (click the link and you will get it)

Answers: 2

Mathematics, 21.06.2019 19:30

Louis wants to carpet the rectangular floor of his basement.the basement has an area of 864 square feet.the width of the basement is 2/3 it's length. what is the length of louis's basement

Answers: 1

Mathematics, 21.06.2019 20:10

Acolony contains 1500 bacteria. the population increases at a rate of 115% each hour. if x represents the number of hours elapsed, which function represents the scenario? f(x) = 1500(1.15)" f(x) = 1500(115) f(x) = 1500(2.15) f(x) = 1500(215)

Answers: 3

Mathematics, 21.06.2019 22:30

Whats are the trickiest steps to do when adding or subtracting rational expressions? how does knowledge of rational numbers u in adding and subtracting rational expressions?

Answers: 2

You know the right answer?

Use the tax tables to determine the tax for the given filing status and taxable income amount:

Head...

Questions

English, 14.06.2020 00:57

Mathematics, 14.06.2020 00:57

Mathematics, 14.06.2020 00:57

Mathematics, 14.06.2020 00:57