Mathematics, 04.02.2020 22:48 keithaaron3803

Calculating the estate tax. joel and rachel are both retired. married for 50 years, they’ve amassed an estate worth $2.4 million. the couple has not trusts or other types of tax-sheltered assets. if joel or rachel dies in 2008, how much federal estate tax would the surviving spouse have to pay, assuming that the estate is taxed at the 45 percent rate?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 14:00

Toyland is having a sale. all items are 20% off. how much will you save on an item that usually sells for 95$ explain your

Answers: 1

Mathematics, 21.06.2019 19:00

Write the expression in complete factored form. 5n_(c - 3) - n(c - 3) =

Answers: 2

Mathematics, 21.06.2019 19:30

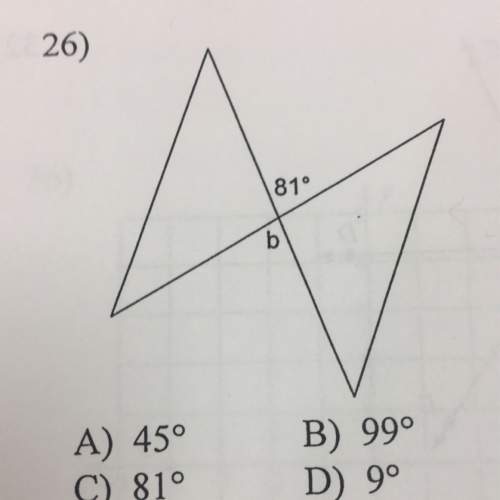

1. are the corresponding angles congruent 2. find the ratios of the corresponding sides 3. is triangle jkl congruent to triangle rst? if so what is the scale factor

Answers: 1

You know the right answer?

Calculating the estate tax. joel and rachel are both retired. married for 50 years, they’ve amassed...

Questions

Chemistry, 20.11.2019 11:31

English, 20.11.2019 11:31

Mathematics, 20.11.2019 11:31

Mathematics, 20.11.2019 11:31

Mathematics, 20.11.2019 11:31

English, 20.11.2019 11:31

Mathematics, 20.11.2019 11:31

English, 20.11.2019 11:31

Mathematics, 20.11.2019 11:31

Mathematics, 20.11.2019 11:31