Mathematics, 25.02.2021 19:30 anymouse110

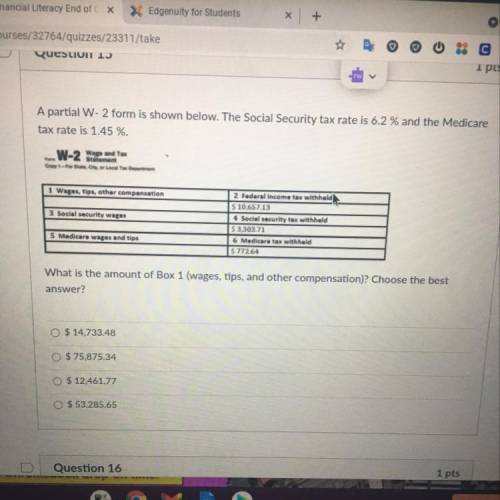

A partial W-2 form is shown below. The Social Security tax rate is 6.2 % and the Medicare

tax rate is 1.45 %.

9 Wape and Tax

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:30

Consider 6x2 + 6x + 1. which term immediately tells you that this expression is not a perfect square trinomial? justify your answer

Answers: 2

Mathematics, 21.06.2019 19:30

Carlos spent 1 1/4 hours doing his math homework he spent 1/4 of his time practicing his multiplication facts how many hours to carlos been practicing his multiplication facts

Answers: 2

Mathematics, 21.06.2019 21:30

Scott’s bank account showed a balance of $750 on sunday. during the next five days, he made one deposit of $140 and numerous withdrawals of $180 each. let x represent the number of withdrawals that scott made. write an inequality that can be used to find the maximum number of withdrawals that scott could have made and maintain a balance of at least $100. do not use a dollar sign ($) in your response.

Answers: 1

Mathematics, 21.06.2019 22:40

Explain in a minimum of 2 sentences how to graph the equation of the absolute value function given a vertex of (-1,3) and a value of “a” equal to ½.

Answers: 2

You know the right answer?

A partial W-2 form is shown below. The Social Security tax rate is 6.2 % and the Medicare

tax rate...

Questions

Spanish, 22.05.2020 04:57

Mathematics, 22.05.2020 04:57

History, 22.05.2020 04:57

Mathematics, 22.05.2020 04:57

Chemistry, 22.05.2020 04:57

Mathematics, 22.05.2020 04:57

Mathematics, 22.05.2020 04:57

English, 22.05.2020 04:57

History, 22.05.2020 04:57