2007 Federal Income Tax Table

Single:

Over But not over

The tax is

$0 $7,825 10%...

Mathematics, 22.02.2021 18:10 tjk0709

2007 Federal Income Tax Table

Single:

Over But not over

The tax is

$0 $7,825 10% of the amount over $0

$7,825 $31,850 $788 + 15% of the amount over $7,825

$31,850 $77,100 $4,386 + 25% of the amount over $31,850

$77,100 $160,850 $15,699 + 28% of the amount over $77,100

$160,850 $349.700 $39,149 + 33% of the amount over $160,850

$349,700 And Over $101.469 + 35% of the amount over $349,700

Maria Contrerras earned $53,000 in taxable income. She figured her tax from the single taxpayer table above.

1. Find her earned income level.

2. Enter the base amount = $4,386

3. Find the amount over $

=$

4. Multiply line 3 by 25% = $

5. Add Lines 2 and 4 = $

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:00

Which unit of measure would be the most appropriate to measure the capacity of a bottle of nail polish? a.fluid ounces b.cups c.pints d.quarts e.gallons

Answers: 1

Mathematics, 21.06.2019 22:30

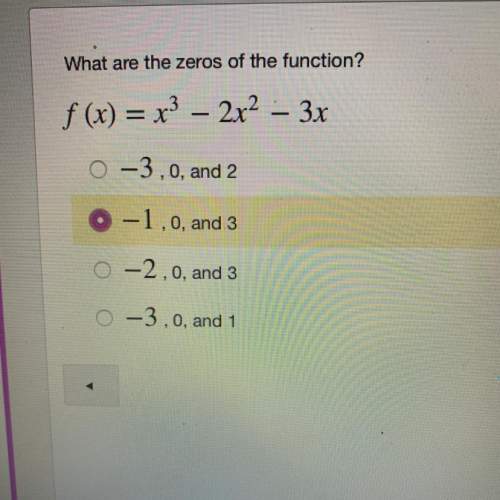

I’ve been trying all day to figure this puzzle out. i need the work for it aswell. it is a factoring polynomials tarsia. the image is below.

Answers: 3

You know the right answer?

Questions

Mathematics, 16.03.2020 16:43

Mathematics, 16.03.2020 16:43

Computers and Technology, 16.03.2020 16:43

Computers and Technology, 16.03.2020 16:44

History, 16.03.2020 16:44