Mathematics, 03.02.2021 20:00 drma1084

The seller of a property has paid $2,700 in property taxes for the year in advance. The closing date of the sale is December 24 and the buyer owns the home on the closing day. How much does the buyer owe the seller in prorated property taxes? Assume the year has 365 days.

a $2,700.00

b $51.78

c $7.40

d $44.38

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:20

At his new job, jeremiah can choose an hourly rate of $9 plus a $50 weekly bonus for opening the store, or an hourly rate of $10 per hour with no opening bonus. the equations model his salary options. y = 9x + 50 y = 10x

Answers: 2

Mathematics, 21.06.2019 21:30

Alcoa was $10.02 a share yesterday. today it is at $9.75 a share. if you own 50 shares, did ou have capital gain or loss ? how much of a gain or loss did you have ? express the capital gain/loss as a percent of the original price

Answers: 2

Mathematics, 22.06.2019 00:00

Alice is paying her bill at a restaurant. but tax on the cost of a male is 5%. she decides to leave a tip 20% of the cost of the meal plus the tax

Answers: 3

Mathematics, 22.06.2019 02:30

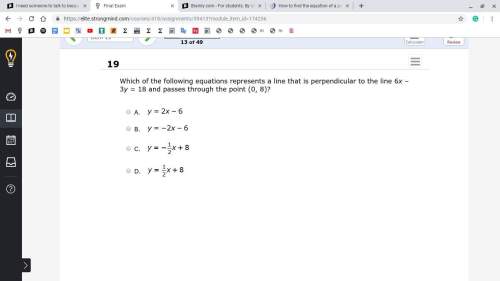

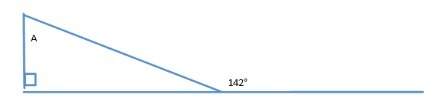

The interior angles formed by the sides of a hexagon have measures that sum to 720°. what is the measure of angle a? enter your answer in the box. m∠a= °

Answers: 3

You know the right answer?

The seller of a property has paid $2,700 in property taxes for the year in advance. The closing date...

Questions

Mathematics, 21.08.2019 00:30

Mathematics, 21.08.2019 00:30

Mathematics, 21.08.2019 00:30

Geography, 21.08.2019 00:30

Mathematics, 21.08.2019 00:30

German, 21.08.2019 00:30

English, 21.08.2019 00:30

History, 21.08.2019 00:30