Mathematics, 08.12.2020 16:50 coolgirl10020031

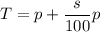

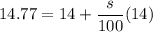

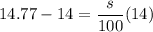

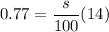

When you buy an item on which sales tax is charged, the total cost is calculated by the formula T=P+s/100p where T is the total cost, p is the items price, and s is the sales tax rate (as a percent). If you pay $14.77 for an item priced at $14, what was the tax rate ?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:30

The bake stars picked 907 apples last weekend at a local orchard they made caramel apples and sold them in the bakery in trays of 6

Answers: 1

Mathematics, 21.06.2019 20:00

Someone answer asap for ! max recorded the heights of 500 male humans. he found that the heights were normally distributed around a mean of 177 centimeters. which statements about max’s data must be true? a. the median of max’s data is 250 b. more than half of the data points max recorded were 177 centimeters. c. a data point chosen at random is as likely to be above the mean as it is to be below the mean. d. every height within three standard deviations of the mean is equally likely to be chosen if a data point is selected at random.

Answers: 1

Mathematics, 22.06.2019 00:00

Yvaries directly as x. y =90 when x=6. find y when x=13

Answers: 1

You know the right answer?

When you buy an item on which sales tax is charged, the total cost is calculated by the formula T=P+...

Questions

Chemistry, 26.10.2021 21:50

Mathematics, 26.10.2021 21:50

Mathematics, 26.10.2021 21:50

Mathematics, 26.10.2021 21:50

Mathematics, 26.10.2021 21:50

Mathematics, 26.10.2021 21:50

Social Studies, 26.10.2021 21:50

Mathematics, 26.10.2021 21:50

English, 26.10.2021 21:50

Mathematics, 26.10.2021 21:50

Biology, 26.10.2021 21:50

History, 26.10.2021 21:50