Mathematics, 07.12.2020 01:20 ari313

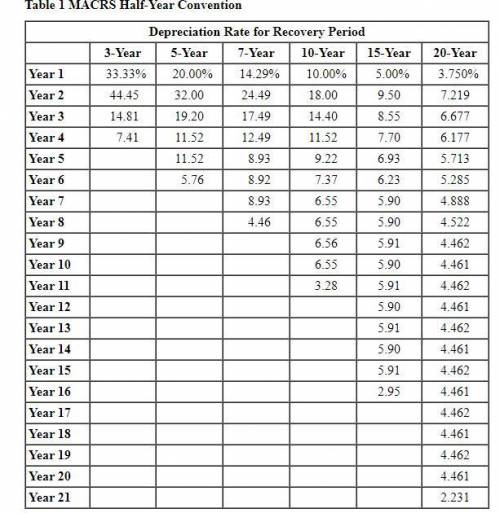

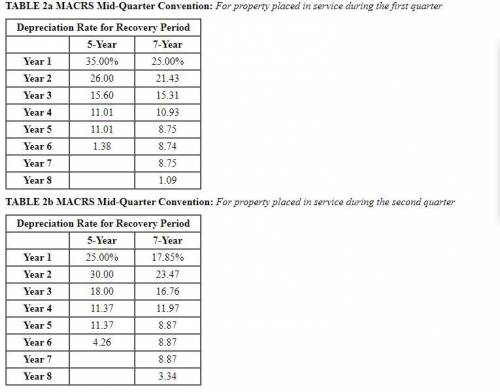

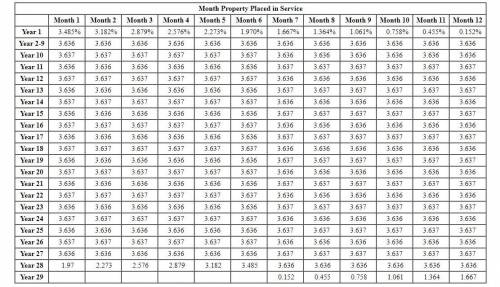

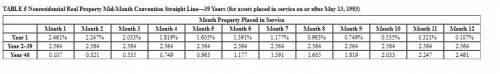

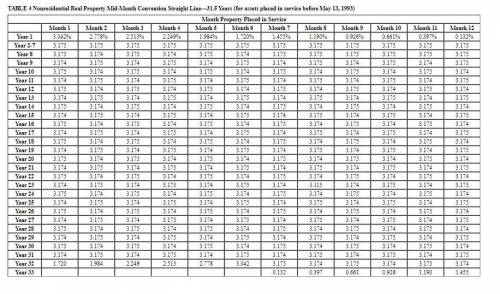

AMP Corporation ( calendar-year-end) has 2019 taxable income of $1,900,000 for purposes of computing the 179 expense. During 2019, AMP acquired the following assests ( Use MACRS Table 1 , Table 2, Table 3, Table 4, and Table 5._

Asset Machinery , Places in Service Sepetember 12 , Basics $1,460,000

Asset Computer Equipment Placed in Service February 10 Basis $460,000

Asset Office Building Placed in service April 2 Basis $565,000

Total = $2,475,000

a) What is the maxium amount of 179 expense AMP may deduct for 2019?

Maximum 179 expense dedeuctible _

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:20

Find the value of x for which abcd must be a parallelogram -9-6x x-30

Answers: 2

Mathematics, 21.06.2019 16:30

In two or more complete sentences describe how to determine the appropriate model for the set of data, (1,1), (3,2), (6,3), (11,4).

Answers: 1

Mathematics, 21.06.2019 19:20

Find the area of an equilateral triangle with a side of 6 inches

Answers: 2

Mathematics, 21.06.2019 19:30

Solve for x and y: 217x + 131y = 913; 131x + 217y = 827

Answers: 1

You know the right answer?

AMP Corporation ( calendar-year-end) has 2019 taxable income of $1,900,000 for purposes of computing...

Questions

Mathematics, 12.10.2019 19:10

Mathematics, 12.10.2019 19:10

Mathematics, 12.10.2019 19:10

English, 12.10.2019 19:10

Mathematics, 12.10.2019 19:10

English, 12.10.2019 19:10

Mathematics, 12.10.2019 19:10

Mathematics, 12.10.2019 19:10

Physics, 12.10.2019 19:10