Mathematics, 28.11.2020 18:40 Robinlynn228

5. Yield to call Six years ago, the Singleton Company issued 20-year bonds with a 14 percent

annual coupon rate at their $1,000 par value. The bonds had a 9 percent call premium, with 5

years of call protection. Today, Singleton called the bonds. Compute the realized rate of return

for an investor who purchased the bonds when they were issued and held them until they were

called. Explain why the investor should or should not be happy that Singleton called them.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 14:30

Bismuth-210 is an isotope that radioactively decays by about 13% each day, meaning 13% of the remaining bismuth-210 transforms into another atom (polonium-210 in this case) each day. if you begin with 233 mg of bismuth-210, how much remains after 8 days?

Answers: 3

Mathematics, 21.06.2019 15:00

Consider the diagram. which line segment has the same measure as st? rx tx sr xs

Answers: 3

Mathematics, 21.06.2019 19:30

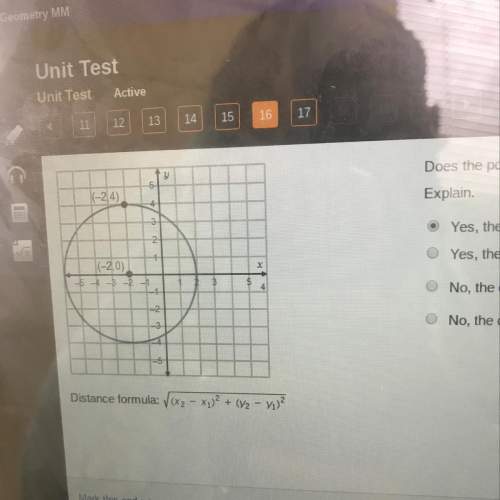

We just started the introduction into circles and i have no idea how to do this.

Answers: 3

Mathematics, 21.06.2019 19:30

What are the solutions to the following equation? |m| = 8.5 the value of m is equal to 8.5 and because each distance from zero is 8.5.

Answers: 3

You know the right answer?

5. Yield to call Six years ago, the Singleton Company issued 20-year bonds with a 14 percent

annual...

Questions

Mathematics, 19.01.2021 20:10

Mathematics, 19.01.2021 20:10

History, 19.01.2021 20:10

Mathematics, 19.01.2021 20:10

Chemistry, 19.01.2021 20:10

Mathematics, 19.01.2021 20:10

Mathematics, 19.01.2021 20:10

Mathematics, 19.01.2021 20:10

Mathematics, 19.01.2021 20:10

Mathematics, 19.01.2021 20:10

History, 19.01.2021 20:10