Mathematics, 25.11.2020 01:40 googoo4

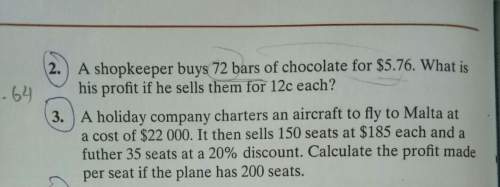

SECTION 2-4 PRACTICE

For problems 3–7 use the Social Security tax rate of 6.2 percent and Medicare

tax rate of 1.45 percent to determine each tax and the total deduction.

Gross Soc. Sec. Tax Medicare Tax

Total

Pay

Withheld

Withheld

Deduction

3.

a.

C!

b.

b.

а.

C.

4.

5.

$ 125.00

432.00

241.00

1,562.00

2,521.00

a.

b.

C.

a.

b.

c.

6.

7.

b.

C.

a.

US 4

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:30

What is the best reason for jacinta to have a savings account in addition to a checking account

Answers: 1

Mathematics, 21.06.2019 20:00

Wich statement could be used to explain why the function h(x)= x^3 has an inverse relation that is also a function

Answers: 3

Mathematics, 21.06.2019 20:00

The holiday party will cost $160 if 8 people attend.if there are 40 people who attend the party, how much will the holiday party cost

Answers: 1

You know the right answer?

SECTION 2-4 PRACTICE

For problems 3–7 use the Social Security tax rate of 6.2 percent and Medicare<...

Questions

Mathematics, 20.11.2019 23:31

History, 20.11.2019 23:31

Mathematics, 20.11.2019 23:31

Mathematics, 20.11.2019 23:31

History, 20.11.2019 23:31

Mathematics, 20.11.2019 23:31

Mathematics, 20.11.2019 23:31

Mathematics, 20.11.2019 23:31

Mathematics, 20.11.2019 23:31

Physics, 20.11.2019 23:31

History, 20.11.2019 23:31

Chemistry, 20.11.2019 23:31

Computers and Technology, 20.11.2019 23:31

Biology, 20.11.2019 23:31

Mathematics, 20.11.2019 23:31

Biology, 20.11.2019 23:31