Mathematics, 04.11.2020 19:00 onlymyworld27

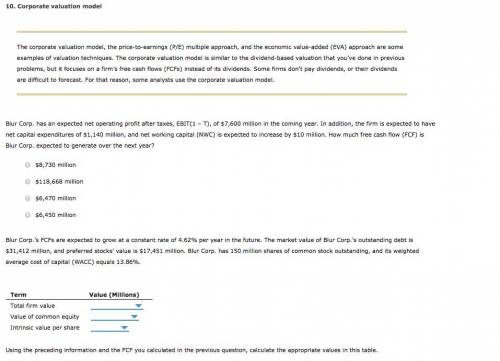

Blur Corp.'s FCFs are expected to grow at a constant rate of 4.62% per year in the future. The market value of Blur Corp.'s outstanding debt is $31,412 million, and its preferred stocks' value is $17,451 million. Blur Corp. Has 150 million shares of common stock outstanding, and its weighted average cost of capital (WACC) equals 13.86%.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:30

If you apply the below transformations to the square root parent function, f(x) = vx, what is the equation of the new function? • shift 12 units right. • shift seven units down.

Answers: 1

Mathematics, 21.06.2019 19:20

What is the measure of ac? 5 units 13 units 26 units 39 units 3x- 2b 6x + 9

Answers: 2

Mathematics, 21.06.2019 21:30

Create a graph for the demand for starfish using the following data table: quantity/price of starfish quantity (x axis) of starfish in dozens price (y axis) of starfish per dozen 0 8 2 6 3 5 5 2 7 1 9 0 is the relationship between the price of starfish and the quantity demanded inverse or direct? why? how many dozens of starfish are demanded at a price of five? calculate the slope of the line between the prices of 6 (quantity of 2) and 1 (quantity of 7) per dozen. describe the line when there is a direct relationship between price and quantity.

Answers: 3

You know the right answer?

Blur Corp.'s FCFs are expected to grow at a constant rate of 4.62% per year in the future. The marke...

Questions

Chemistry, 05.02.2021 20:00

Spanish, 05.02.2021 20:00

English, 05.02.2021 20:00

Mathematics, 05.02.2021 20:00

Physics, 05.02.2021 20:00

Health, 05.02.2021 20:00

Mathematics, 05.02.2021 20:00

Mathematics, 05.02.2021 20:00

Mathematics, 05.02.2021 20:00

Mathematics, 05.02.2021 20:00