Mathematics, 02.11.2020 17:00 applesass

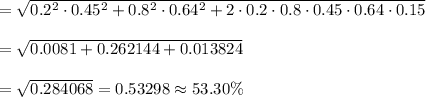

Security F has an expected return of 12.0 percent and a standard deviation of 45.0 percent per year. Security G has an expected return of 17.0 percent and a standard deviation of 64.0 percent per year. a. What is the expected return on a portfolio composed of 20 percent of Security F and 80 percent of Security G? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) b. If the correlation between the returns of Security F and Security G is .15, what is the standard deviation of the portfolio described in part (a)? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 20:00

Given the equation y − 4 = three fourths(x + 8) in point-slope form, identify the equation of the same line in standard form. −three fourthsx + y = 10 3x − 4y = −40 y = three fourthsx + 12 y = three fourthsx + 10

Answers: 1

Mathematics, 22.06.2019 00:00

Which of the following is the maximum value of the equation y=-x^2+2x+5 a. 5 b. 6 c. 2. d. 1

Answers: 1

You know the right answer?

Security F has an expected return of 12.0 percent and a standard deviation of 45.0 percent per year....

Questions

History, 13.11.2020 03:20

Spanish, 13.11.2020 03:20

Arts, 13.11.2020 03:20

Mathematics, 13.11.2020 03:20

History, 13.11.2020 03:20

Mathematics, 13.11.2020 03:20

Mathematics, 13.11.2020 03:20

English, 13.11.2020 03:20

English, 13.11.2020 03:20

Spanish, 13.11.2020 03:20

Mathematics, 13.11.2020 03:20

Chemistry, 13.11.2020 03:20

Computers and Technology, 13.11.2020 03:20