Mathematics, 30.10.2020 20:50 jonmorton159

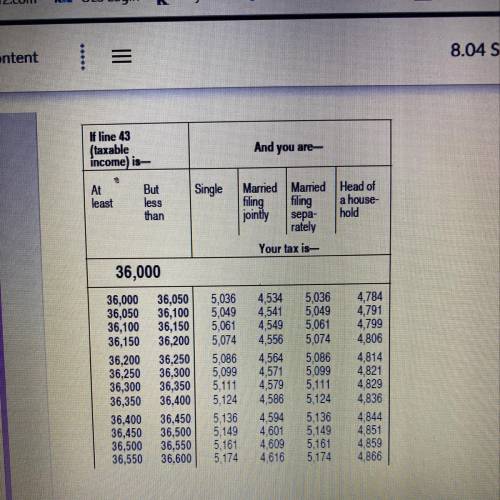

David's taxable income is $36,480. He is filing as married filing jointly, and he has already paid $4047 in federal taxes. What will he receive or pay after he figures his taxes for the year?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:30

Paint color preference children adults total 0.6 0.77 liked new paint color disliked new paint color 0.4 0.15 0.23 total 1.0 1.0 1.0 which value for x completes the conditional relative frequency table by column?

Answers: 2

Mathematics, 21.06.2019 21:10

If f(x) and g(x) are inverse functions of each other, which of the following shows the graph of f(g(x)

Answers: 1

Mathematics, 21.06.2019 21:50

What is the 17th term in the arithmetic sequence in which a6 is 101 and a9 is 83

Answers: 1

Mathematics, 22.06.2019 00:20

Convert the number to decimal form. 12) 312five a) 82 b) 30 c) 410 d) 1560 13) 156eight a) 880 b) 96 c) 164 d) 110 14) 6715eight a) 53,720 b) 3533 c) 117 d) 152

Answers: 1

You know the right answer?

David's taxable income is $36,480. He is filing as married filing jointly, and he has already paid $...

Questions

Mathematics, 20.11.2020 17:20

Health, 20.11.2020 17:20

English, 20.11.2020 17:20

Mathematics, 20.11.2020 17:20

History, 20.11.2020 17:20

Mathematics, 20.11.2020 17:20

Mathematics, 20.11.2020 17:20

Mathematics, 20.11.2020 17:20

Mathematics, 20.11.2020 17:20