Mathematics, 20.10.2020 05:01 sarbjit879

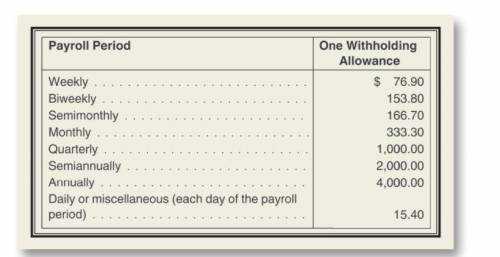

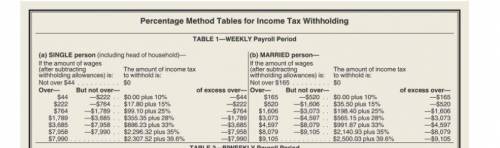

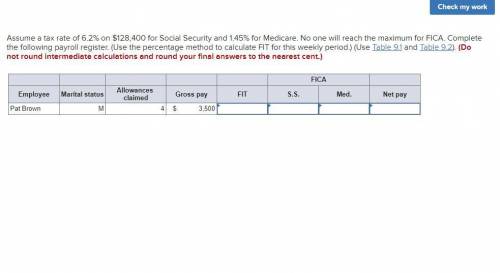

Assume a tax rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. (Use the percentage method to calculate FIT for this weekly period.)

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:00

Assume that the weights of quarters are normally distributed with a mean of 5.67 g and a standard deviation 0.070 g. a vending machine will only accept coins weighing between 5.48 g and 5.82 g. what percentage of legal quarters will be rejected? round your answer to two decimal places.

Answers: 1

Mathematics, 21.06.2019 18:00

The price of an item has been reduced by 30%. the original price was $30. what is the price of the item now ?

Answers: 1

Mathematics, 21.06.2019 19:20

What is the measure of ac? 5 units 13 units 26 units 39 units 3x- 2b 6x + 9

Answers: 2

You know the right answer?

Assume a tax rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. No one will reach...

Questions

Computers and Technology, 09.10.2019 22:30

Mathematics, 09.10.2019 22:40

Social Studies, 09.10.2019 22:40

Social Studies, 09.10.2019 22:40

Advanced Placement (AP), 09.10.2019 22:40