Mathematics, 19.10.2020 14:01 carethegymnast8954

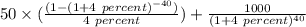

Cox Media Corporation pays a 10 percent coupon rate on debentures that are due in 20 years. The current yield to maturity on bonds of similar risk is 8 percent. The bonds are currently callable at $1,150. The theoretical value of the bonds will be equal to the present value of the expected cash flow from the bonds. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 12:40

Which shows the image of rectangle abcd after the rotation (x, y) → (–y, x)?

Answers: 3

Mathematics, 21.06.2019 13:50

Asimple random sample of size nequals14 is drawn from a population that is normally distributed. the sample mean is found to be x overbar equals 70 and the sample standard deviation is found to be sequals13. construct a 90% confidence interval about the population mean

Answers: 2

Mathematics, 21.06.2019 17:30

Let f(x) = x+3 and g(x) = 1/x the graph of (fog)(x) is shown below what is the range of (fog)(x)?

Answers: 2

Mathematics, 21.06.2019 20:00

If benito is selecting samples of five values from the table, which row will result in the greatest mean? population data row 1 4 2 2 3 3 row 2 3 3 4 3 2 row 3 2 4 3 4 3 row 4 3 4 4 7 3 row 1 row 2 r

Answers: 1

You know the right answer?

Cox Media Corporation pays a 10 percent coupon rate on debentures that are due in 20 years. The curr...

Questions

English, 10.02.2021 18:50

Mathematics, 10.02.2021 18:50

Mathematics, 10.02.2021 18:50

Mathematics, 10.02.2021 18:50

Mathematics, 10.02.2021 18:50

Mathematics, 10.02.2021 18:50

Business, 10.02.2021 18:50