Mathematics, 16.10.2020 20:01 twentyonepilots12018

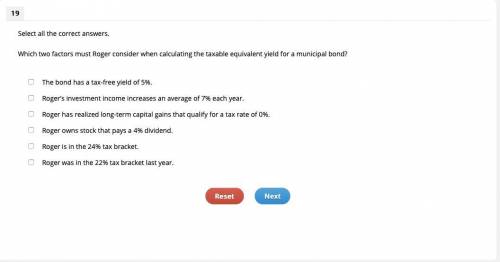

Which two factors must Roger consider when calculating the taxable equivalent yield for a municipal bond?

A. The bond has a tax-free yield of 5%.

B. Roger’s investment income increases an average of 7% each year.

C. Roger has realized long-term capital gains that qualify for a tax rate of 0%.

D. Roger owns stock that pays a 4% dividend.

E. Roger is in the 24% tax bracket.

F. Roger was in the 22% tax bracket last year.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:20

Cot(90° − x) = 1 the value of x that satisfies this equation is °. a. 60 b. 135 c. 225 d. 315

Answers: 1

Mathematics, 22.06.2019 00:20

20 ! need ! which exponential function is represented by the table? f(x) = 0.2(0.5x)f(x) = 0.5(5x)f(x) = 0.5(0.2x)f(x) = 0.2(0.2x)

Answers: 1

Mathematics, 22.06.2019 02:00

(30 points). the population of a city is 45,000 and decreases 2% each year. if the trend continues, what will the population be aer 15 yrs

Answers: 2

You know the right answer?

Which two factors must Roger consider when calculating the taxable equivalent yield for a municipal...

Questions

History, 30.08.2019 03:30

Physics, 30.08.2019 03:30

Mathematics, 30.08.2019 03:30

Biology, 30.08.2019 03:30

World Languages, 30.08.2019 03:30

Computers and Technology, 30.08.2019 03:30

Mathematics, 30.08.2019 03:30

English, 30.08.2019 03:40

Mathematics, 30.08.2019 03:40