Mathematics, 13.10.2020 05:01 rosepederson80

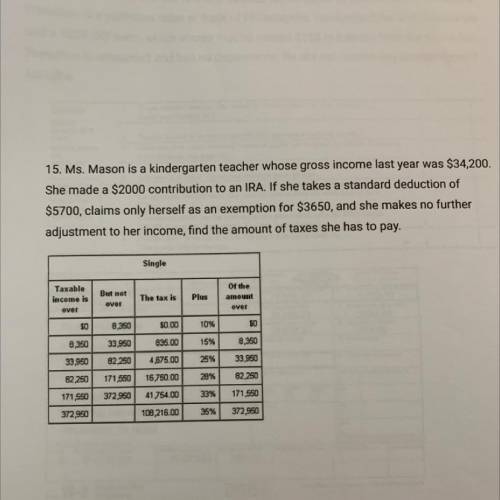

15. Ms. Mason is a kindergarten teacher whose gross income last year was $34,200.

She made a $2000 contribution to an IRA. If she takes a standard deduction of

$5700, claims only herself as an exemption for $3650, and she makes no further

adjustment to her income, find the amount of taxes she has to pay.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 13:00

Determine the quotient and remainder when (6a3)+11a2-4a-9) is divided by (3a-2) express your answer in the form q(a) + r(a)/d(a)

Answers: 1

Mathematics, 21.06.2019 14:30

Translate the following situation into an inequality statement . lily has $25 to spend on a charm bracelet for her sisters birthday gift the cost of the bracelet is $12 plus $1.50 per charm

Answers: 1

Mathematics, 21.06.2019 20:10

Right triangle xyz has a right angle at vertex y and a hypotenuse that measures 24 cm. angle zxy measures 70º. what is the length of line segment xy? round to the nearest tenth. 8.2 cm 8.7 cm 22.6 m 25.5 cm

Answers: 1

Mathematics, 21.06.2019 20:30

Solve each quadratic equation by factoring and using the zero product property. x^2 + 18x = 9x

Answers: 2

You know the right answer?

15. Ms. Mason is a kindergarten teacher whose gross income last year was $34,200.

She made a $2000...

Questions

Mathematics, 28.08.2020 17:01

English, 28.08.2020 17:01

Mathematics, 28.08.2020 17:01

Mathematics, 28.08.2020 17:01

Mathematics, 28.08.2020 17:01

Mathematics, 28.08.2020 17:01

Mathematics, 28.08.2020 17:01

Mathematics, 28.08.2020 17:01

Mathematics, 28.08.2020 17:01

Social Studies, 28.08.2020 17:01