Mathematics, 05.09.2020 19:01 F00Dislife

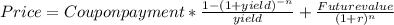

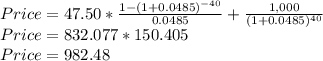

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000, and it makes semiannual interest payments. If you require an 10.7% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 21:40

If angle b measures 25°, what is the approximate perimeter of the triangle below? 10.3 units 11.8 units 22.1 units 25.2 units

Answers: 2

Mathematics, 22.06.2019 00:00

An equation in slope-intersept form the lines that passes thought (-8,1) and is perpindicular to the y=2x-17.

Answers: 1

Mathematics, 22.06.2019 01:20

Me i'm timed ! a. -2 to 1 b. -1.5 to 0.5c. 0 to 1d. 0.5 to 1.5

Answers: 2

You know the right answer?

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon...

Questions

Mathematics, 08.12.2020 14:50

History, 08.12.2020 14:50

World Languages, 08.12.2020 14:50

World Languages, 08.12.2020 14:50

Social Studies, 08.12.2020 14:50

Biology, 08.12.2020 14:50

Mathematics, 08.12.2020 14:50

English, 08.12.2020 14:50

Mathematics, 08.12.2020 14:50

Mathematics, 08.12.2020 14:50

English, 08.12.2020 15:00

Medicine, 08.12.2020 15:00