Porter had a taxable income of $34,050 and filed his federal income tax

return with the Single...

Mathematics, 26.05.2020 22:58 freeman36

Porter had a taxable income of $34,050 and filed his federal income tax

return with the Single filing status. Using the table below find the amount he

has to pay in taxes.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 13:10

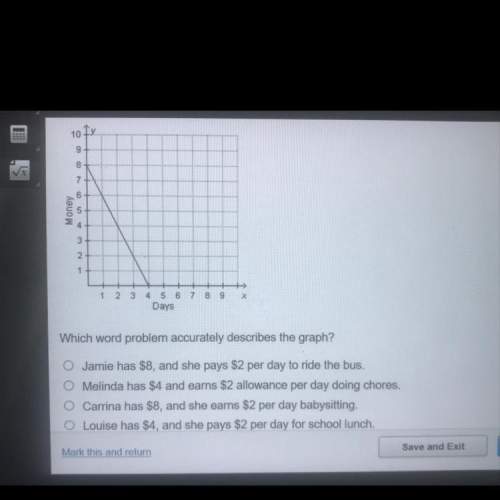

What graph correctly matches the equation y equals two negative x

Answers: 1

Mathematics, 22.06.2019 00:30

Francisco's credit card has an apr of 28.98%, calculated on the previous monthly balance. his credit card record for the last 7 months is shown in the table below francisco is trying to figure out what this all means. answer the following questions: what is the total amount that francisco has paid in interest over the 7 months? what is the total amount that francisco has made in payments over the 7 months? how much of francisco's payments have gone to paying down the principal on his account? what is francisco's new balance at the end of month 8? what will francisco be charged for interest for month 8?

Answers: 2

Mathematics, 22.06.2019 06:10

Azookeeper predicted the weight of a new baby elephant to be 233 pounds when it was born. the elephant actually weighed 265 pounds at birth. what was the percent error of the zookeeper's prediction? asap

Answers: 3

Mathematics, 22.06.2019 07:00

The diagram shows how an image is produced by a plane mirror. which letter shows where the image will be produced?

Answers: 1

You know the right answer?

Questions

English, 23.11.2019 20:31

Biology, 23.11.2019 20:31

Social Studies, 23.11.2019 20:31

English, 23.11.2019 20:31

Mathematics, 23.11.2019 20:31

Biology, 23.11.2019 20:31

Social Studies, 23.11.2019 20:31