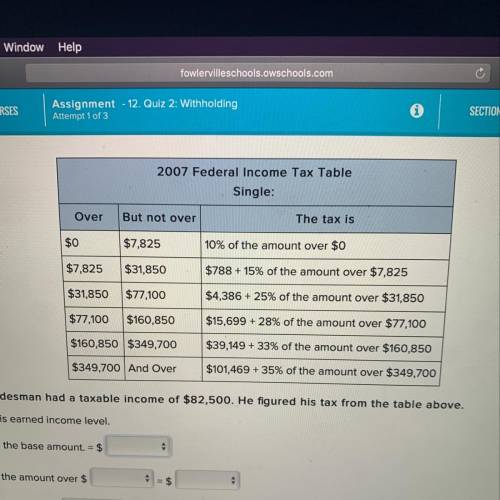

Tim Tradesman had a taxable income of $82,500. He figured his tax from the table above.

1. Fin...

Mathematics, 26.04.2020 04:07 hollie62

Tim Tradesman had a taxable income of $82,500. He figured his tax from the table above.

1. Find his earned income level.

2. Enter the base amount. = $ 1,512.002815,699.0017,211.005,400.0 077,100.00

3. Find the amount over $ 5,400.0017,211.0015,699.0077,100.00 1,512.0028 = $ 1,512.0017,211.0015,699.005,400.002 877,100.00

4. Multiply line 3 by 15,699.001,512.005,400.0077,100.001 7,211.0028% = $ 5,400.001,512.0077,100.002815,699.0 017,211.00

5. Add Lines 2 and 4 = $ 5,400.0077,100.002815,699.001,512.0 017,211.00

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 16:50

What is the perimeter of square abcd? units units 28 units 37 units

Answers: 2

Mathematics, 21.06.2019 17:50

When using the linear combination metho e linear combination method to solve a system of linear equations, the four options are:

Answers: 1

Mathematics, 21.06.2019 19:00

Write an introductory paragraph for this corrie ten boom and her family were faced with some difficult choices after hitler came to power. some family members paid the ultimate price. write a carefully thought-out paper of at least 200 words dealing with the following concepts: --how should a christian act when evil is in power? --what do you think it would be like to live in an occupied country? remember to proofread anything you write thoroughly.

Answers: 1

You know the right answer?

Questions

Mathematics, 27.06.2019 22:20

Health, 27.06.2019 22:20

History, 27.06.2019 22:20

History, 27.06.2019 22:20

Social Studies, 27.06.2019 22:20

History, 27.06.2019 22:20