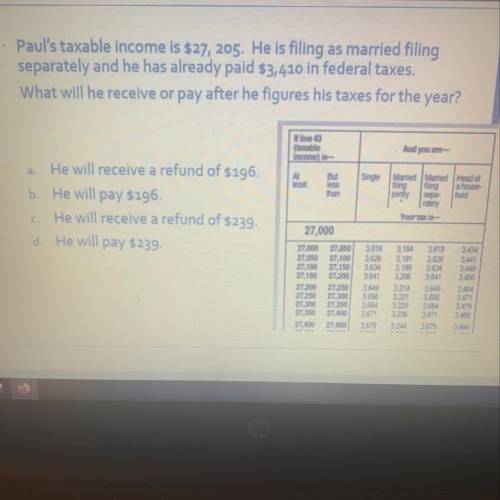

· Paul's taxable income is $27, 205. He is filing as married filing

separately and he has alre...

Mathematics, 11.04.2020 06:55 kimjooin02

· Paul's taxable income is $27, 205. He is filing as married filing

separately and he has already paid $3,410 in federal taxes.

What will he receive or pay after he figures his taxes for the year?

Answers: 3

Another question on Mathematics

Mathematics, 22.06.2019 00:30

The power generated by an electrical circuit (in watts) as a function of its current c (in amperes) is modeled by p(c)= -15c(c-8) what current will produce the maximum power?

Answers: 1

Mathematics, 22.06.2019 00:40

If a distance of 75 yds is measured back from the edge of the canyon and two angles are measured , find the distance across the canyon angle acb = 50° angle abc=100° a=75 yds what does c equal?

Answers: 1

Mathematics, 22.06.2019 01:30

If a sprinkler waters 1 over 12 of a lawn in 1 over 2 hour, how much time will it take to water the entire lawn? (5 points) 10 hours 6 hours 1 over 6 hour 7 over 12 hour

Answers: 1

You know the right answer?

Questions

Mathematics, 05.05.2020 21:42

Computers and Technology, 05.05.2020 21:42

Mathematics, 05.05.2020 21:42

Mathematics, 05.05.2020 21:42

Biology, 05.05.2020 21:42

Mathematics, 05.05.2020 21:42

Mathematics, 05.05.2020 21:42

Mathematics, 05.05.2020 21:42

French, 05.05.2020 21:42

Computers and Technology, 05.05.2020 21:42