Mathematics, 09.04.2020 01:19 VampireQueen01

Employee earned $37,000 during the year working for an employer when the maximum limit for social security was $118,500 each calendar year. the fica tax rate for social security is 6.2% and the fica tax rate for medicare is 1.45%. the employee's annual fica taxes amount is:

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 13:00

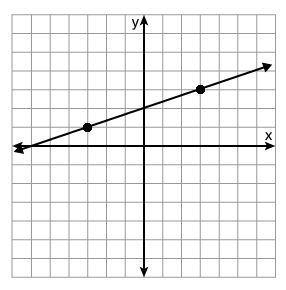

X+ y = k 2x + 3y = k + 1 the point of intersection of the lines has an x-coordinate of a.2k + 1 b.-2k + 1 c.2k - 1

Answers: 1

Mathematics, 21.06.2019 17:00

Alonso walked with his friend andy one day, and wanted to compare their speeds. alonso walked 3 miles in one hour, and andy walked 2 miles in 2 hours. complete the table to graph the relationship for each person.

Answers: 3

Mathematics, 21.06.2019 19:20

Which of the following quartic functions has x = –1 and x = –2 as its only two real zeroes?

Answers: 1

Mathematics, 21.06.2019 20:30

Two triangles can be formed with the given information. use the law of sines to solve the triangles. b = 49°, a = 16, b = 14

Answers: 3

You know the right answer?

Employee earned $37,000 during the year working for an employer when the maximum limit for social se...

Questions

Biology, 05.11.2019 14:31

History, 05.11.2019 14:31

Mathematics, 05.11.2019 14:31

Health, 05.11.2019 14:31

Mathematics, 05.11.2019 14:31

Mathematics, 05.11.2019 14:31

English, 05.11.2019 14:31

History, 05.11.2019 14:31

Mathematics, 05.11.2019 14:31