Mathematics, 02.04.2020 01:11 egirl7838

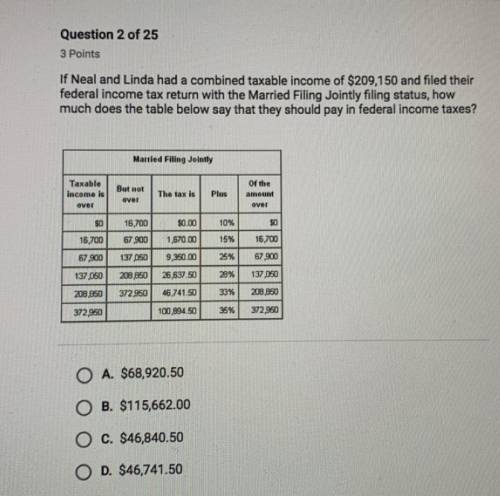

If Neal and Linda had a combined taxable income of $209,150 and filed their federal income tax return with the married filing jointly filing status, how much does the table below say that they should pay in federal income taxes?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 19:20

Which letters from the table represent like terms? a and b b and c a and d b and d

Answers: 3

Mathematics, 21.06.2019 21:00

Given: circle o, cd is diameter, chord ab || cd. arc ab = 74°, find arc ca.

Answers: 1

Mathematics, 21.06.2019 23:30

Fill in the table with whole numbers to make 430 in five different ways

Answers: 1

Mathematics, 22.06.2019 00:50

Margie is practicing for an upcoming tennis tournament. her first serve is good 20 out of 30 times on average. margie wants to know the estimated probability that her first serve will be good at least four of the next six times she serves. how could she design a simulation for this scenario?

Answers: 3

You know the right answer?

If Neal and Linda had a combined taxable income of $209,150 and filed their federal income tax retur...

Questions

Geography, 14.05.2021 04:20

English, 14.05.2021 04:20

Social Studies, 14.05.2021 04:20

Mathematics, 14.05.2021 04:20

History, 14.05.2021 04:20

Arts, 14.05.2021 04:20

Mathematics, 14.05.2021 04:20

Mathematics, 14.05.2021 04:20

Mathematics, 14.05.2021 04:20